Advertisement|Remove ads.

Colgate Falls Over 5%: SEBI RA Flags Growth Stagnation, Need For Disruption

Colgate-Palmolive (India) shares fell over 5% in Thursday’s trade, following lukewarm earnings and rising concerns around its stagnant growth trajectory.

According to SEBI-registered analyst Jeet Bhayani, Colgate has been reporting largely constant numbers over the past several quarters, with minimal growth in both revenue and net profit.

This stagnation suggests that the business has reached the upper limit of its current growth trajectory unless the company introduces innovative strategies or products to boost sales.

Bhayani emphasizes that for Colgate to generate short-term momentum and break out of its current plateau, it needs a significant product launch capable of disrupting the B2C segment.

From a technical standpoint, Bhayani identified the ₹2,674 to ₹2,800 range as a key resistance zone for the stock — levels it continues to struggle breaking above.

Thursday’s selloff pushed Colgate well below this band, indicating waning confidence in the near-term story.

Colgate-Palmolive reported a 1.9% year-on-year decline in March-quarter revenue, which fell short of street expectations.

Net profit fell 6.5%, and margins were also under pressure due to increased input costs and muted volume growth.

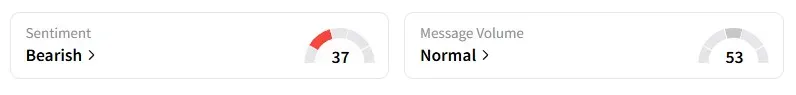

Even the retail sentiment on this counter is ‘bearish’, according to data from Stocktwits.

Colgate Palmolive shares fell 6% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)