Advertisement|Remove ads.

Colgate-Palmolive Strikes Deal To Buy Australian Pet Food Brand Prime100: Retail Mood Improves

Shares of Colgate-Palmolive rose 0.4% in after-hours trading on Tuesday as the company agreed to buy Care TopCo Pty Ltd, which owns the Australia-based Prime100 pet food brand, reviving retail sentiment.

The transaction is not expected to have a material impact on diluted earnings per share in 2025, according to a Colgate-Palmolive statement.

With the deal, Colgate-Palmolive’s Hill’s Pet Nutrition division will get an entry into the ‘fast-growing’ fresh pet food sector while also boosting its presence in the Australian pet food market, the company said.

Melbourne-based Prime100 sells refrigerated and shelf-stable products to specialty and other retailers in Australia.

“Prime100 is a strong, veterinarian-endorsed, premium-priced brand with distinctive positioning that fits well within our long-term pet nutrition growth strategy,” said Noel Wallace, Colgate’s chairman, president and CEO. “We are excited that this acquisition will add a high-growth, profitable fresh dog food asset to the Hill’s division portfolio with the opportunity to drive continued growth through expanded distribution and awareness.”

The deal, terms of which were not disclosed, will be financed with a combination of debt and cash. The deal will be subject to regulatory approval in Australia and slated to close in the second quarter of 2025.

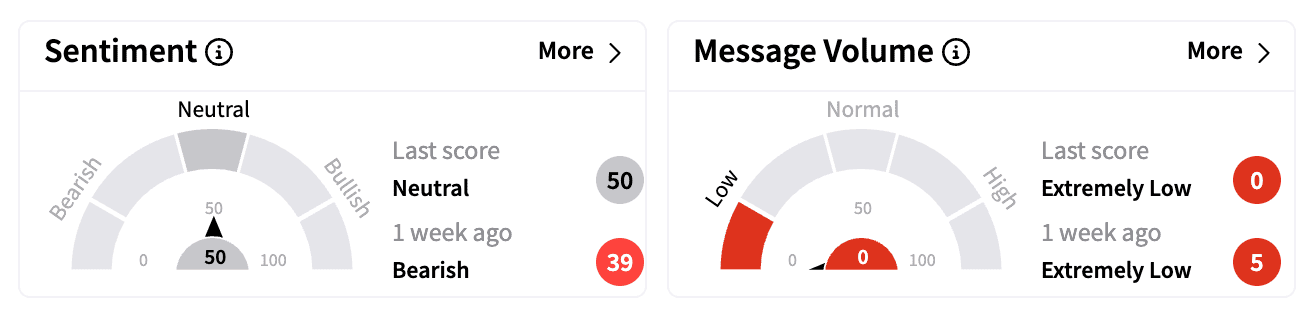

Sentiment on Stocktwits improved to ‘neutral’ from ‘bearish’ a week ago. Message volumes remained in the ‘extremely low’ zone.

One bullish commenter on the Stocktwits platform was optimistic about the company’s stock reaching beyond $91.

Colgate-Palmolive’s brands span multiple segments including oral care, personal care, home care and pet nutrition. Its brands include Softsoap, Ajax, Murphy, Soupline, Hill’s Science Diet and Hill’s Prescription Diet.

Colgate-Palmolive stock is down 4.97% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210921290_jpg_46bb1e6211.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213245133_jpg_7b8ad24799.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234770702_jpg_792acca270.webp)