Advertisement|Remove ads.

CommScope Stock Rockets 91% As Retail Bulls Cheer $10.5B Asset Sale: ‘Get In While It’s Cheap!’

CommScope Holding Company Inc. (COMM) witnessed retail sentiment and message volume hit a one-year high on Stocktwits on Monday after the company struck a deal to divest its Connectivity and Cable Solutions (CCS) division to Amphenol Corporation (APH) in an all-cash transaction valued at $10.5 billion.

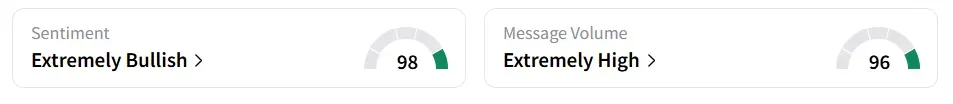

The transaction is slated to close in the first half of 2026, pending shareholder approval and regulatory clearance. CommScope stock traded over 91% higher by Monday afternoon. Retail sentiment around the stock shifted to ‘extremely bullish’ (98/100) from ‘bullish’ territory the previous day. Message volume jumped to ‘extremely high’ (96/100) from ‘normal’ levels in 24 hours.

A Stocktwits user lauded the buyout.

Another user expects the stock to finish above $15, saying ‘Get in while it’s cheap!’

The agreement marks a major reshaping of CommScope’s business portfolio as it focuses on core operations. The company anticipates net proceeds of roughly $10 billion once taxes and fees are accounted for, and a significant portion will go toward paying off all existing debt and redeeming its preferred shares, currently held by The Carlyle Group Inc. (CG).

The company noted it will retain some leverage on its remaining operations but expects to hold a substantial cash reserve after the transaction.

Once the sale is completed and all financial obligations are settled, CommScope intends to return surplus funds to investors. A dividend distribution is expected within 60 to 90 days of closing, though final details, including the exact payout, will be determined later.

The company also reported its second-quarter (Q2) revenue of $1.39 billion, beating the analysts’ consensus estimate of $1.25 billion, as per Fiscal AI data. CommScope stock has gained over 188% year-to-date and over 643% in the past 12 months.

Also See: Amazon’s Podcast Bet Falters As Job Cuts Loom At Wondery: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_atomera_logo_resized_97a56614c5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1248428688_jpg_059f14eab1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Palo_Alto_logo_1200pi_resized_jpg_eee56769fa.webp)