Advertisement|Remove ads.

Conduit Pharmaceuticals Enters Development Agreement With Manoira To Test Drugs In Animals: Retail Sees Stock Above $10

Shares of Conduit Pharmaceuticals Inc. (CDT) tumbled 17% on Wednesday after the company announced that it has entered into a development agreement with privately held animal health company Manoira Corporation.

As part of the agreement, Manoira will evaluate Conduit's clinical-stage candidates AZD1656 and AZD5658 in animal health indications.

Manoira will initially focus on the evaluation of AZD1656 in animal Osteoarthritis. Osteoarthritis is a degenerative joint condition in companion animals.

The collaboration will help Conduit accelerate its understanding of AZD1656's mechanism of action, safety profile, and potential efficacy across species, while retaining ownership of all data and intellectual property generated for human applications.

The partnership, Conduit said, opens potential new revenue streams in the high-growth veterinary market.

The parties will determine any future financial benefits and implications upon review of the results of the evaluations and how to proceed as a result of any such findings, Conduit said.

Manoira has agreed to fund all the developmental activities of the collaboration, and Conduit has agreed to issue Manoira an up-front consideration of $500,000. Conduit’s consideration will be settled through the issuance of 154,799 shares of common stock at $3.23, or its closing price on Tuesday.

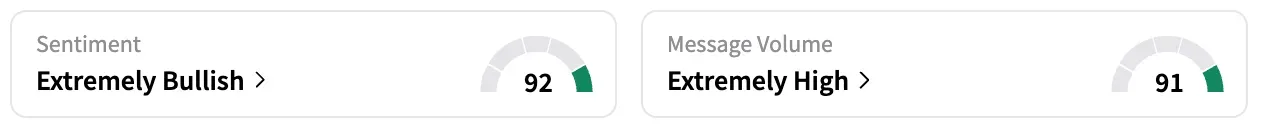

On Stocktwits, retail sentiment around CDT stayed unmoved within the ‘extremely bullish’ territory over the past 24 hours while message volume remained at ‘extremely high’ levels.

A Stocktwits user said that they bought the stock during the dip.

Another sees it rising back to over $10.

CDT stock is down by approximately 98% this year and has lost most of its value over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)