Advertisement|Remove ads.

ConocoPhillips Reportedly Mulls Sale Of Permian Assets For $2B

- The deal comes as part of a broader streamlining of its portfolio, as per the report.

- The oil and gas company is reportedly looking for buyers in consultation with advisers.

- Strategic as well as private equity suitors are likely to show interest in the sale.

ConocoPhillips (COP) is reportedly considering a sale of some of its Permian Basin assets that are expected to be valued at around $2 billion.

According to a report from Bloomberg, which cited people familiar with the matter, the assets being considered were acquired through deals with Concho Resources Inc. (CXO) and Shell Plc (SHEL).

The deal comes as part of a broader streamlining of its portfolio, as per the report.

COP stock was down nearly 1% at the time of writing.

Deal Details

ConocoPhillips is looking to divest assets in the Delaware Basin, one of the most productive oil fields in the United States, and a part of the Permian Basin in West Texas and New Mexico, as per the report.

The oil and gas company is reportedly looking for buyers in consultation with advisers. As per the report, strategic as well as private equity suitors are likely to show interest in the sale.

The sale consideration is still at an early stage and ConocoPhillips may decide not to sell the assets, as per the report from Bloomberg.

Earnings Snapshot

The company reported fourth-quarter (Q4) 2025 earnings earlier this month, posting earnings of $1.4 billion, about 40% lower compared to earnings of $2.3 billion in the same period in 2024.

Earnings per share was $1.17 per share, although after accounting for one-time charges, earnings came in at $1.02 per share, lower than analyst estimates of $1.09 per share, as per data from Fiscal.ai.

The oil and gas major said that it had completed $3.2 billion worth dispositions in 2025 and is on track for $5 billion total dispositions in 2026.

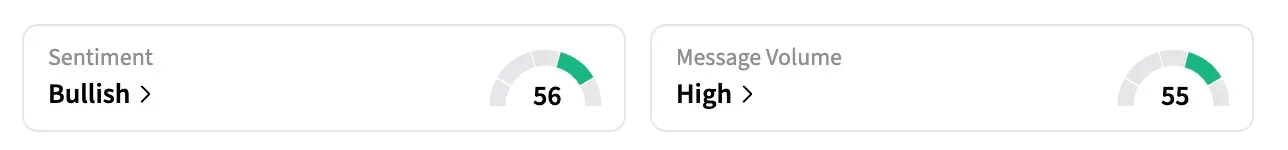

How Did Stocktwits Users React?

On Stocktwits, retail sentiment around COP shares remained in the ‘bullish’ territory over the past 24 hours amid ‘high’ message volumes.

Shares of COP have gained more than 8% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210271447_jpg_cc4a4c2122.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2183291686_jpg_0cf9c99142.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sentinelone_logo_resized_676c16b69c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228372233_jpg_0ab0e02ff6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)