Advertisement|Remove ads.

Consumer Price Index Up 2.8% In February, Rises Less Than Expected: Markets Cheer But Recession Fears Linger

U.S. Consumer prices rose less than expected in February, with the consumer price index (CPI) rising 0.2% month-on-month and 2.8% on an annual basis.

According to a CNBC report, economists surveyed by Dow Jones expected headline CPI to come in at 0.3% and 2.9%, respectively.

Core inflation, which excludes food and energy prices, rose 0.2% in February and increased 3.1% over the last 12 months. According to a Bloomberg report, the core CPI increase is the smallest since April 2021. Economists had expected core CPI to come in at 0.3% and 3.2%, respectively.

According to the Bureau of Labor Statistics (BLS), the index for shelter rose 0.3% in February, accounting for nearly half of the monthly increase for all items. However, the uptick was partially offset by a 4% decrease in the index for airline fares and a 1% decline in the index for gasoline.

The BLS also noted that the energy index rose 0.2% over the month as electricity and natural gas indexes increased.

“The index for food also increased in February, rising 0.2% as the index for food away from home increased 0.4%. The food at home index was unchanged over the month,” the BLS said.

Futures jumped on Wednesday morning pre-market after the softer-than-expected inflation data. The SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust, Series 1 (QQQ) rose over 1% each.

According to Bloomberg, Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities, believes this is “a much-needed softer reading in CPI.”

“It doesn’t shift much for the Fed as a lot has happened since this data was collected. But we do expect energy prices to continue coming down as the year evolves,” he said.

Immediately following the CPI data release, traders expect a status quo policy from the Federal Reserve in March. A 25 basis point rate cut has been factored in for June 2025.

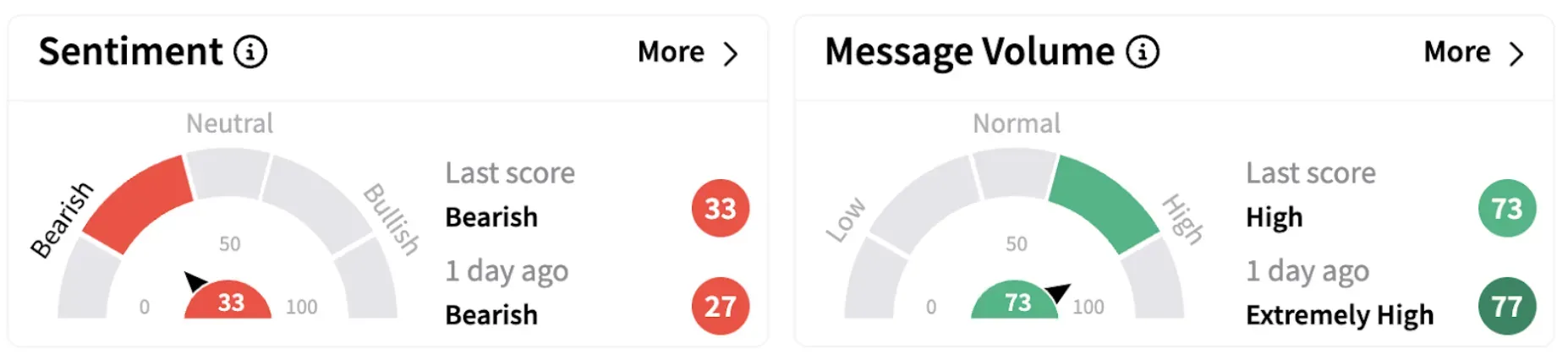

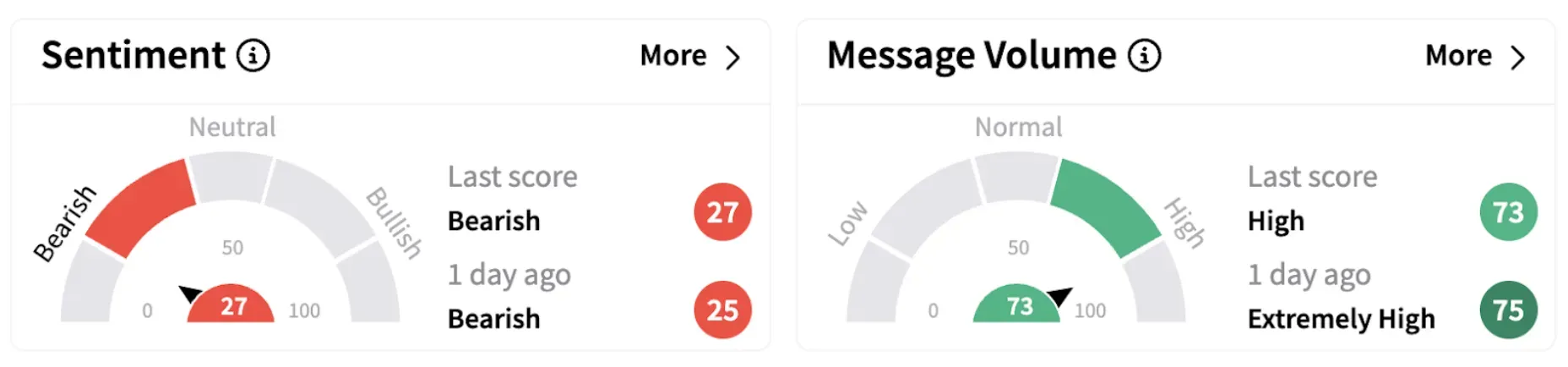

On Stocktwits, retail sentiment for SPY and QQQ continued to trend in the ‘bearish’ territory on Wednesday morning.

One Stocktwits user expressed skepticism about the low inflation numbers, which they believe might be a prelude to a recession.

Another believes that although the figures are reasonable, it may take a while for the impact of tariffs to be reflected.

All eyes are now on the Fed’s policy outcome next week, which will have a huge impact on the economy.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)