Advertisement. Remove ads.

Retail Investors ‘Extremely Bullish’ On This Once Bankrupt Bitcoin-Miner

Bitcoin-miner Core Scientific (CORZ) found a place among the most trending stocks on Stocktwits Tuesday after the firm announced the expansion of a deal with Nvidia-backed CoreWeave. The stock was trading over 15% higher on Tuesday following the announcement.

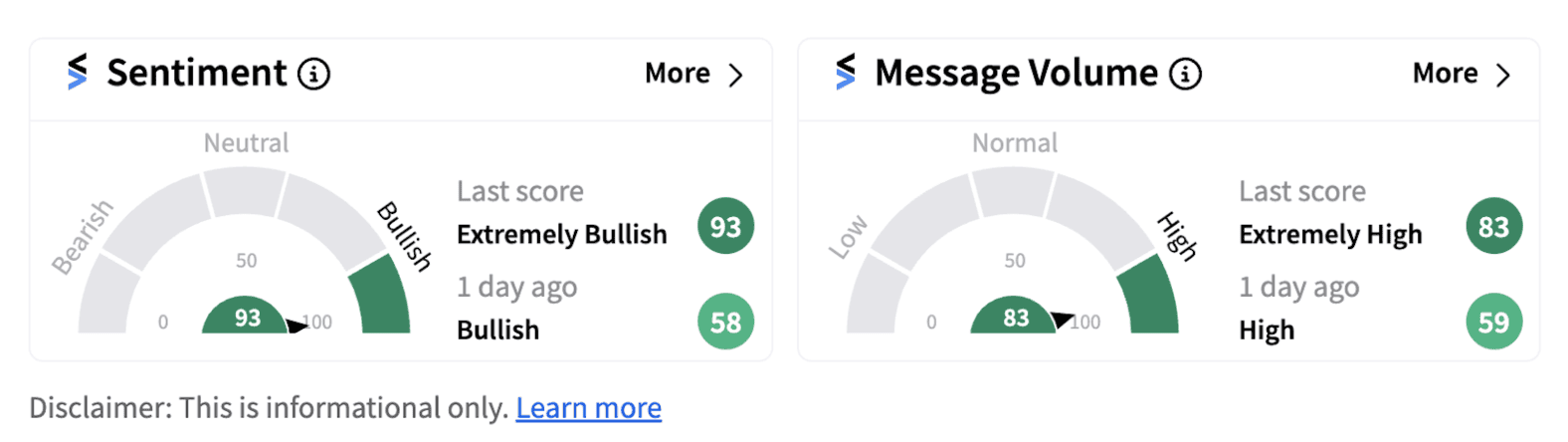

Shares of the firm, which was bankrupt and having a difficult time keeping lenders onboard earlier this year, attracted immense amounts of retail interest following the announcement. Retail sentiment on Stocktwits flipped into the ‘extremely bullish’ territory (93/100) amid ‘extremely high’ message volumes.

Core Scientific said that under the terms of the deal, the firm will modify its infrastructure to deliver approximately 112 incremental megawatts (MW) for high performance computing (HPC) to host CoreWeave’s NVIDIA GPUs.

The firm said this new 12-year HPC hosting contract will further expand its exposure to contracted, multi-year, dollar-denominated revenue. “The new contract with CoreWeave is expected to add approximately $2 billion in projected additional cumulative revenue over the hosting contract’s 12-year term,” it said. The deal increases its potential cumulative revenue to over $6.70 billion through the 12 year term.

Adam Sullivan, Core Scientific’s Chief Executive Officer pointed out that the firm has contracted with CoreWeave for a total of 382 megawatts of HPC infrastructure, reflecting the strong demand for high-power data center infrastructure.

Interestingly, all capital investments required to modify Core Scientific’s existing infrastructure into cutting-edge, application-specific data centers customized for dense HPC will be funded by CoreWeave.

Core Scientific stock has made a tremendous recovery this year, having gained over 176% since its January IPO closing price.

Investors are now awaiting the firm’s second-quarter earnings scheduled to be released after the bell on Wednesday. Stocktwits users like Samurai0 believe the firm’s results will likely provide further insights into its expansion plans and growth potential.

/filters:format(webp)https://news.stocktwits-cdn.com/iphone_resized_jpg_a228d5a43e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_IPO_offering_resized_jpg_77ee5f67f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199291636_jpg_3c282601d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermarket_aisle_resized_jpg_26c6e8576d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_9c9db98ee3.webp)