Advertisement|Remove ads.

CoreWeave Gets Wall Street Upgrade As AI Demand Builds

- Deutsche Bank cited signs of strengthening demand and potential upside to revenue forecasts for the cloud infrastructure provider.

- CoreWeave has been gaining attention as demand for generative artificial intelligence infrastructure has picked up.

- On Monday, Nvidia made a fresh $2 billion investment in CoreWeave to boost the development of more than 5 gigawatts of AI factories by 2030.

Deutsche Bank has upgraded CoreWeave Inc. (CRWV) to a ‘Buy’ rating from ‘Hold’, setting a new target price of $140 per share ahead of the company’s upcoming fourth-quarter earnings.

The price target implies a potential 43% upside to CoreWeave’s closing price as of Monday.

CoreWeave stock traded over 6% higher in Tuesday’s premarket.

Analyst Rationale

Deutsche Bank cited signs of strengthening demand and potential upside to revenue forecasts for the cloud infrastructure provider as key reasons behind the upgrade, according to TheFly.

CoreWeave has been gaining attention as demand for generative artificial intelligence infrastructure picks up pace, with the company focusing on delivering high-performance computing capacity to major clients.

The firm sees room for analysts’ revenue expectations for the company to climb materially through 2026 if the business can execute on its planned capacity and maintain contracted commitments.

Nvidia’s Investment

On Monday, Nvidia made a fresh $2 billion investment in CoreWeave to boost the development of more than 5 gigawatts of AI factories by 2030. CoreWeave will use Nvidia’s high-performance computing platform to design and operate AI factories, with the latter also helping acquire land, utilities, and infrastructure necessary for factory construction.

Post the deal announcement, Jefferies said Nvidia’s backing through land access and ready-powered facilities should lower operational risks and make it easier for CoreWeave to grow. The firm also noted that Nvidia is expected to assist CoreWeave in bringing its SUNK and Mission Control software to customers.

All Eyes On Q4 Earnings

The company is scheduled to report its Q4 earnings on February 9, and analysts see a revenue of $1.53 billion with a loss per share (EPS) of $0.49.

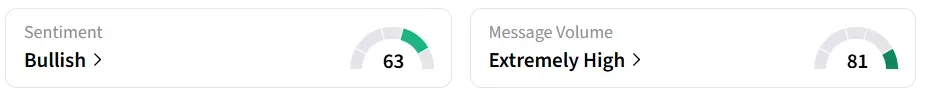

On Stocktwits, retail sentiment around the stock jumped to ‘bullish’ from ‘neutral’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘normal’ levels in 4 hours.

CRWV stock has gained over 145% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)