Advertisement|Remove ads.

CorMedix Q1 Earnings Trump Estimates: Retail’s Overjoyed

Shares of CorMedix Inc. (CRMD) traded 17% higher on Tuesday morning after the company’s first-quarter (Q1) earnings beat Wall Street expectations.

The company reported net revenue of $39.1 million for the first quarter from the sales of DefenCath, above an analyst estimate of $36 million, as per Finchat data.

DefenCath aims to reduce the incidence of catheter-related bloodstream infections in adult patients receiving chronic hemodialysis with central venous catheters.

It was approved by the U.S. Food and Drug Administration (FDA) in November 2023 and launched by the company in inpatient and outpatient settings last year.

The company’s net income for the period came in at $20.6 million, compared with a net loss of $14.5 million in the corresponding quarter of 2024.

Diluted earnings per share (EPS) in the quarter stood at $0.30, compared to a loss per share of $0.25 in Q1 2024, and above an estimated EPS of $0.24.

CorMedix now expects its net sales in the first half of the year to be at the high end of its previously announced guidance range of $62 million to $70 million. This is based on the latest order trends and inventory tracking with current purchasing customers.

The company also said that it anticipates continued inpatient growth for DefenCath throughout 2025.

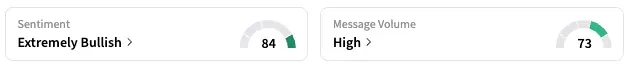

On Stocktwits, retail sentiment around CorMedix jumped from ‘bullish’ to ‘extremely bullish’ territory over the past 24 hours while message volume rose from ‘normal’ to ‘high’ levels.

CRMD stock is up by 28% this year, and by nearly 79% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_vertex_logo_resized_4070318817.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_shell_resized_jpg_161ef0a394.webp)