Advertisement|Remove ads.

Corning Stock Declines As Q4 Revenue Misses Wall Street Estimates: Retail Stays Bullish On Improved Q1 Outlook

Shares of Corning Inc. (GLW) fell over 1% in mid-day trade on Wednesday after the company missed Wall Street’s fourth-quarter revenue estimates.

According to The Fly, the analyst consensus for Corning’s fourth-quarter revenue was $3.77 billion, but the specialty glass maker posted $3.5 billion during this period.

However, the company’s core earnings per share (EPS) came slightly ahead of estimates, at $0.57, compared to the expected $0.56.

“We’re off to a terrific start on our high-confidence ‘Springboard’ plan to add more than $3 billion in annualized sales, and to achieve operating margin of 20%, by the end of 2026,” said Wendell Weeks, chairman and CEO of Corning.

He added that the company will “upgrade” its ‘Springboard’ plan at its upcoming investor event in March, with Corning betting on riding the upward cyclical and secular trends to drive demand for its products.

Ed Schlesinger, EVP and CFO of Corning, laid out the company’s forecast for the first quarter, with an estimated revenue of $3.6 billion and core EPS of $0.48 to $0.52.

According to The Fly, Corning’s first-quarter revenue and core EPS forecasts are ahead of estimates of $3.54 billion and $0.48, respectively.

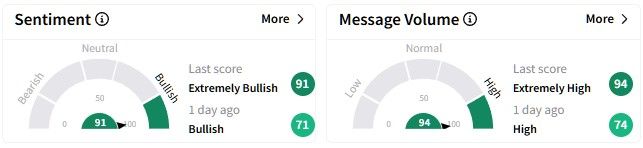

Retail sentiment around Corning stock was in the ‘extremely bullish’ (91/100) territory on Stocktwits, fueled by a better-than-estimated forecast for the first quarter.

Corning’s share price has surged over 18% in the past six months, scaling its 52-week high earlier this week. Over the past year, Corning’s stock has gained nearly 62%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)