Advertisement|Remove ads.

Corvus Gets Price Target Hike From Oppenheimer On Positive Drug Trial Results: Retail’s Pleased

Shares of Corvus Pharmaceuticals, Inc. (CRVS) traded 30% higher on Friday afternoon after Oppenheimer raised its price target on the stock to $17 from $15, while keeping an ‘Outperform’ rating on the stock.

The brokerage cited positive results from a clinical trial announced by the company on Thursday, as per TheFly. Corvus announced new interim data from its Phase 1 clinical trial evaluating Soquelitinib in patients with moderate to severe atopic dermatitis.

The data demonstrated a favorable safety and efficacy profile, particularly in cohort 3, where patients received higher doses of 200 mg twice daily, the company said.

The update continues to support Oppenheimer's enthusiasm for the candidate in this potential blockbuster indication. The firm views these data as highly competitive with Dupilumab and other systemic options for patients with atopic dermatitis.

Oppenheimer’s new price target implies a 407% upside to the stock’s closing price of $3.35 on Thursday.

Corvus on Thursday reported a first-quarter loss of $0.13 per share, marginally higher than the loss of $0.12 reported in the corresponding period of 2024, and above an estimated loss of $0.12, as per Finchat data.

The company ended the quarter with cash, cash equivalents, and marketable securities of $44.2 million compared to $52.0 million as of Dec. 31, 2024, which it expects will fund operations into the fourth quarter of 2026.

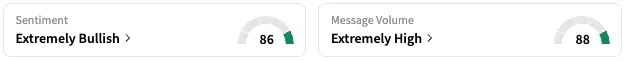

On Stocktwits, retail sentiment around Corvus rose from ‘bullish’ to ‘extremely bullish’ over the past 24 hours while message volume jumped from ‘high’ to ‘extremely high’ levels.

CRVS stock is down by about 20% this year but up by about 115% over the past 12 months.

Also See: InspireMD Stock Dips On Wider-Than-Expected Q1 Loss, But Retail Is Optimistic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_atomera_logo_resized_97a56614c5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1248428688_jpg_059f14eab1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Palo_Alto_logo_1200pi_resized_jpg_eee56769fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_crash_490d43331a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)