Advertisement|Remove ads.

Costco Bumps Quarterly Dividend By 12%: Retail Investors Extremely Optimistic Amid Tariff Turmoil

Costco Wholesale Corp (COST) on Wednesday said it will raise its quarterly dividend by 12% to $1.30 per share.

The new dividend, totaling $5.20 annually, will be paid out on May 16 to shareholders on record as of May 2.

According to Barron's, this brings Costco's dividend yield to about 0.54%. While higher than 0.49% in its last fiscal year ended August 2024, it is below the company's five-year average dividend yield of 0.66%.

The yield is also lower than what several competitors offer, according to Barron's, which said that Walmart's (WMT) dividend yield was 0.85%, Target's (TGT) 3.3%, and Kroger's (KR) 1.97% in the fiscal year ended January.

Costco, which sells through a membership model and focuses on staple goods, is seen to be better placed than others in terms of the potential hit to businesses from new U.S. import tariffs.

Costo's stock has gained over 8% in the past month, while Target's shares have fallen by over 12%.

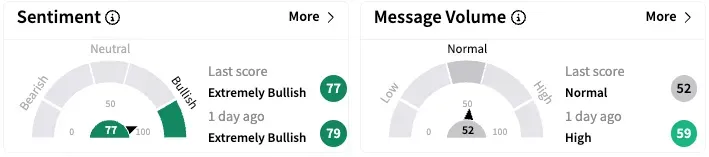

On Stocktwits, retail sentiment for Costco was 'extremely bearish', while message volume fell to 'neutral' from 'high' a day ago.

Several users posted about the dividend announcement.

One user noted that it was the fifth straight year of a double-digit dividend increase and praised the company's membership-focused business model.

Costco shares are up 5.6% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rivian_automotive_jpg_e356c1abe5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252871865_jpg_74865c27a7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)