Advertisement|Remove ads.

Costco Draws Mixed Reactions From Wall Street Despite Q4 Beat: Here’s Why

Costco Wholesale Corp. (COST) drew mixed reactions from Wall Street following its fourth-quarter (Q4) results, with analysts flagging concerns about slowing momentum despite ongoing business strength.

In Q4, the company’s revenue of $86.15 billion and its earnings per share (EPS) of $5.87 both exceeded the analysts’ consensus estimates of $86.05 billion and $5.80, according to Fiscal AI data.

Roth Capital analyst Bill Kirk maintained a ‘Neutral’ stance with a price target of $907, pointing out that the company’s comparable store sales growth hit a six-quarter low, as per TheFly. He also noted that Costco’s membership renewal rates declined by 40 basis points globally and in North America compared to the previous quarter. Kirk emphasized that the softening growth makes the current stock valuation difficult to justify.

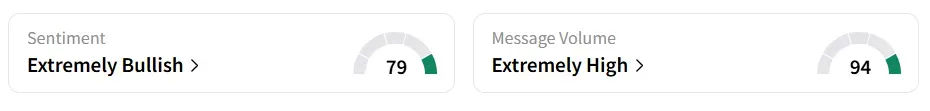

Costco Wholesale stock traded over 2% lower after the morning bell on Friday, and was among the top five trending stock tickers on Stocktwits. Retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

The stock experienced a 641% increase in user message count in 24 hours.

Truist trimmed its price target on the stock to $1,033 from $1,042 while keeping a ‘Hold’ rating. The firm acknowledged Costco’s solid quarterly performance, including a 6.4% gain in core comparable sales. It stated that despite Costco’s resilience and continued market share gains, the current valuation of around 50 times projected earnings makes it "challenging to put fresh money to work".

.JPMorgan took a slightly more optimistic stance, retaining its ‘Overweight’ rating but reducing its price target to $1,050 from $1,160. The firm stated it is not concerned about the drop in renewal rates. Costco’s stock has gained over 1% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)