Advertisement|Remove ads.

Costco Q4 Earnings Beat Estimates, Revenue Falls Short Of Expectations: Retail Is Excited

Costco Wholesale Corporation (COST), on Thursday, posted fourth-quarter earnings that beat analyst estimates even as revenue fell short of expectations. Shares of the firm were trading lower by nearly 1% in Friday’s pre-market session as of 7:45 a.m. ET.

Costco reported diluted earnings per share (EPS) at $5.29, above a consensus estimate of $5.08. Revenue, however, came in at $79.69 billion versus an estimate of $79.93 billion. Net income for the quarter came in at $2.35 billion compared to $2.16 billion in the same quarter a year ago.

Following the earnings, Barclays analyst Seth Sigman reportedly raised the price target on the stock to $850 from $830, while keeping an ‘Equal Weight’ rating on the stock.

The analyst noted that Costco reported another strong quarter, with steady underlying trends, sustained progress in e-commerce including improved profitability, and robust membership trends. Although Barclays expects Costco's momentum to continue, it believes the stock's valuation has factored that in.

Costco had recently increased its membership fees. Gold Star, Business, and Business Add-on/Affiliate membership fees have been increased to $65 from $60 while Executive membership fee has been raised to $130 from $120. The fee increase took place beginning with September 2024 renewals, which members began receiving in mid-July.

CFO Gary Millerchip said during the earnings call that Costco was very deliberate in delaying the membership fee increase until the firm felt that it started to see inflation dissipate and members spend more in non-food categories. “From a member reaction perspective, I'd say, we haven't really heard a significant member reaction,” he noted.

Stifel analyst Mark Astrachan, too, has raised the firm's price target on the stock to $925 from $915, while keeping a ‘Buy’ rating on the shares. The firm believes Costco’s recently enacted membership fee increase will be largely reinvested, further boosting sales and traffic growth over the next 12-18 months.

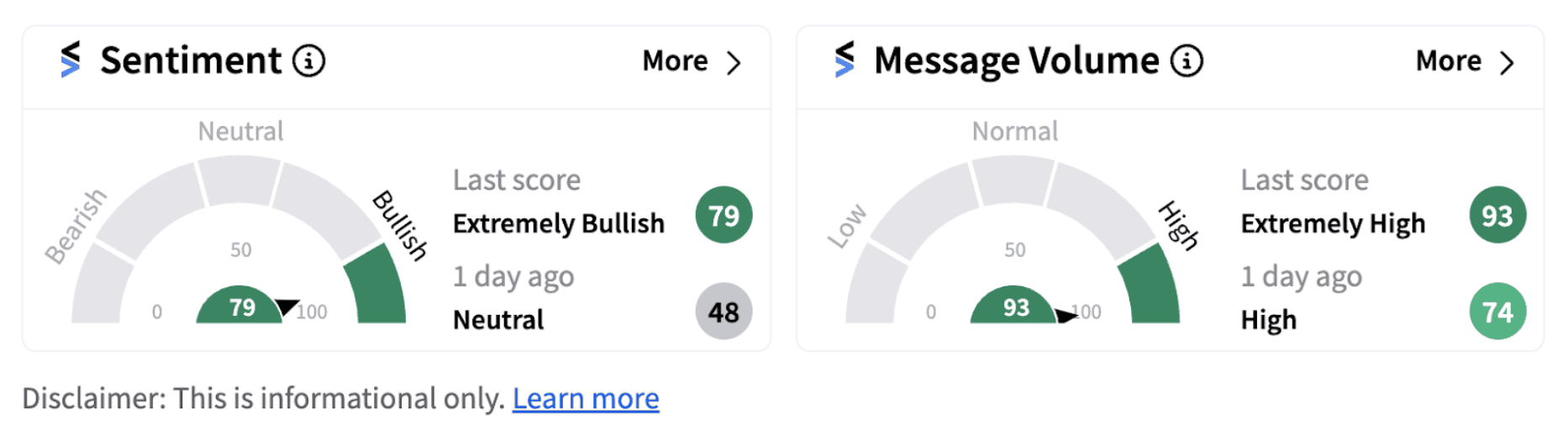

Following the earnings release, retail sentiment on Stocktwits shifted into ‘extremely bullish’ territory (79/100) from ‘neutral’ a day ago, accompanied by ‘extremely high’ message volumes.

Stocktwits users with a bullish outlook on the firm believe the recent decline in its stock price will be short-lived, presenting a buying opportunity.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)