Advertisement|Remove ads.

Coterra Stock In Spotlight After Q4 Profit Beat, Marcellus Basin Production Restart Plan: Retail Chatter Rises

Coterra Energy (CTRA) garnered retail attention after the bell on Monday after the company’s fourth-quarter earnings topped Wall Street’s estimates.

The oil and gas producer posted adjusted earnings of $0.49 per share for the reported quarter, while analysts, on average, expected the company to post $0.43 per share, according to FinChat data.

Its quarterly revenue fell 12.6% to $1.40 billion in the fourth quarter, coming in slightly below estimates.

Shares of the company fell 0.5% in aftermarket trade.

The company’s average sales price of oil was $68.57 per barrel, down from $77.10 per barrel last year. This decline in oil prices was slightly offset by gains in natural gas liquids prices.

Coterra’s total production volume fell to 681,500 barrels of oil equivalent per day (boe/d) from 697,400 boe/d in the year-ago quarter as natural gas production declined at the Marcellus Basin.

The company and its peers had curtailed production at Marcellus in Pennsylvania after natural gas prices slumped last year due to lukewarm demand and elevated storage levels.

Coterra CEO Tom Jorden said the company expects to restart its Marcellus development program in the coming months, which would provide higher natural gas volumes next winter.

The U.S. Energy Information Administration expects benchmark natural gas prices in the U.S. to average $3.80 per British thermal units (MMBtu) in 2025 compared with $2.20 per MMBtu last year.

The Houston-based company reiterated its 2025 production forecast between 710,000 to 770,000 boe/d, aided by a jump in oil production.

In January, Coterra completed asset acquisitions worth nearly $4 billion and gained almost 49,000 acres in the Permian basin.

The company expects to spend between $2.1 and $2.4 billion from 2025 to 2027.

Coterra raised its quarterly base dividend by 5% to $0.22 per share.

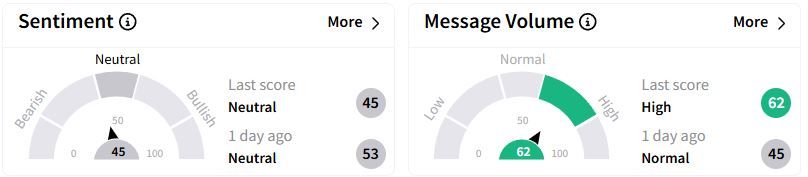

Retail sentiment on Stocktwits dipped further into the ‘neutral’ zone (45/100) compared to the previous day, while message volume surged 1,100%, reaching 'high' levels.

Over the past year, Coterra stock has gained 7.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)