Advertisement|Remove ads.

Chevron Stock Trades In The Green After Leadership Changes, Segment Consolidation: Retail’s Positive Too

Shares of oil major Chevron Corp (CVX) traded in the green on Monday after the company announced several leadership changes and segment consolidation aimed at simplifying its organizational structure.

The company decided to consolidate its Oil, Products & Gas organization into two segments – Upstream and Downstream, Midstream & Chemicals – with Mark Nelson continuing to lead the organization as vice chairman and executive vice president, Oil, Products & Gas.

The company believes the Upstream organizational model will drive value through greater standardization across Shale & Tight, Base Assets & Emerging Countries, Offshore, Eurasia, and Australia.

Clay Neff, president of International Exploration and Production, has been named president of Upstream, effective July 1, 2025, while Bruce Niemeyer, president of Americas Exploration and Production, has been named president of Shale & Tight.

Chevron CEO Mike Wirth said the new organizational structure and leadership appointments are designed to improve the company’s operational efficiency and position Chevron for sustained growth.

“These changes will help enable us to drive innovation and execution and deliver value for our shareholders,” he said.

Recently, the company said it would lay off between 15% and 20% of its workforce. The workforce reduction would begin in 2025 and is likely to complete before the end of 2026.

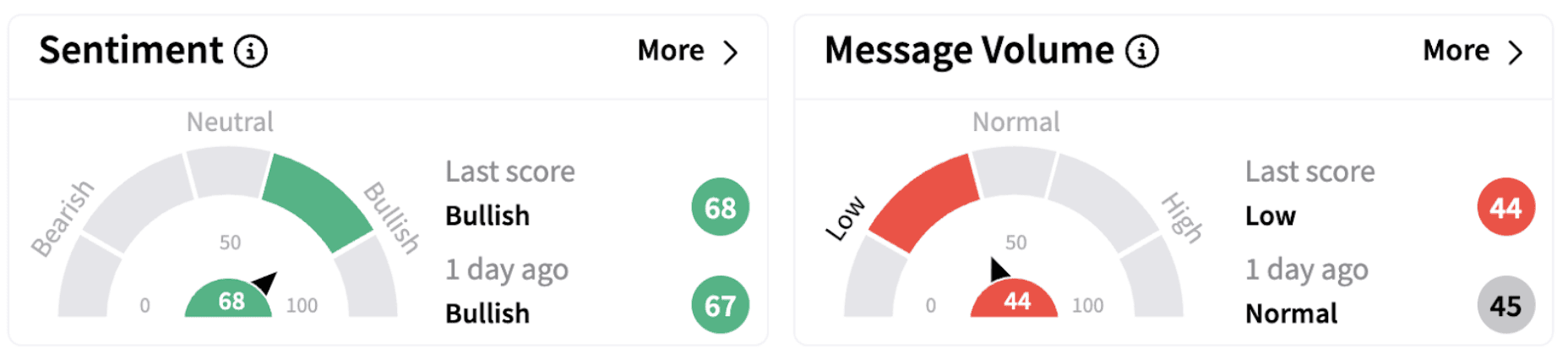

On Stocktwits, retail sentiment surrounding Chevron continued to trend in the ‘bullish’ territory (68/100).

Retail chatter, however, indicated a mixed take on the stock.

Chevron shares have risen over 7% in 2025 and are up over 2% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kashkari_original_jpg_b7db42a385.webp)