Advertisement|Remove ads.

Cramer Flags ‘Longest Shutdown’ Risk – ‘You Do Not Want An Up Opening’

- Cramer appears to have shifted from his previous position that shutdowns don't significantly impact markets.

- The federal government shutdown has reached 36 days, breaking the previous 35-day record set during Trump's first term.

- Nearly a million federal workers remain unpaid as the closure extends into November.

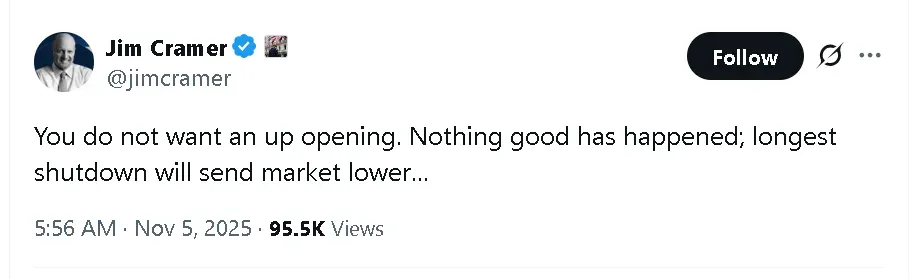

Jim Cramer cautioned investors on Wednesday that a positive market opening may be misleading, citing the potential impact of what could become the longest U.S. government shutdown in history.

“You do not want an up opening. Nothing good has happened,” Cramer wrote in a post on X. “Longest shutdown will send market lower.”

Shutdown Clouds Market Outlook

The Mad Money host's warning comes as nearly a million federal workers remain unpaid during the ongoing shutdown, which has now extended into November – surpassing the 35-day shutdown during Donald Trump's first term that ended in January 2019. While Cramer previously maintained that government shutdowns have historically not significantly hurt markets, this extended closure is testing that thesis.

He added that most investors are, anyway, more focused on a single stock on Wednesday morning, hinting at Advanced Micro Devices (AMD).

AMD’s price was down 3.7% in pre-market trade on Wednesday despite the company beating Wall Street expectations with earnings per share (EPS) of $1.2 on revenue of $9.25 billion, ahead of analyst estimates of an EPS of $1.17 on revenue of $8.76 billion, according to Stocktwits data. Retail sentiment around the AI behemoth on Stocktwits trended in ‘bearish’ territory even as chatter rose to ‘high’ from ‘low’ levels over the past day.

Broad Market Reaction Reflects Uncertainty

Meanwhile, overall U.S. equities were in the red during pre-market trade on Wednesday. The SPDR S&P 500 ETF (SPY) dipped 0.25%, the SPDR Dow Jones Industrial Average ETF (DIA) slipped 0.05%, and the Nasdaq-100 tracking Invesco QQQ Trust (QQQ) moved 0.42% lower. Retail sentiment around QQQ on Stocktwits remained in ‘extremely bearish’ territory over the past day, even as chatter remained at ‘high’ levels.

Read also: Crypto Markets See $1.7 Billion In Liquidations As Fear Index Hits Lowest Levels Since April

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)