Advertisement|Remove ads.

Cramer Slams Intel As Manufacturing Ambitions Falter: Retail Stays Skeptical

CNBC Mad Money host Jim Cramer on Wednesday highlighted that Intel Corp.’s (INTC) chip-manufacturing division lost $18.8 billion in 2024 despite receiving help from government subsidies.

In late July, the chipmaker revealed it may cut down its ambitions to grow its semiconductor production arm, sparking doubts about the direction of its manufacturing plans.

Cramer took to the X platform to express his disappointment about the company.

Intel stock inched 0.1% higher in Wednesday’s premarket.

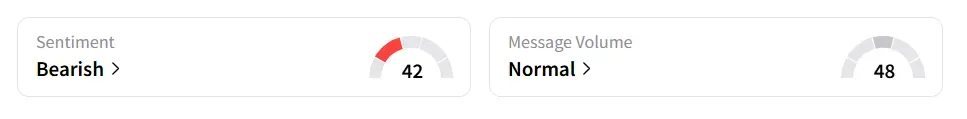

According to Stocktwits data, Intel saw a 143% increase in user message count in 24 hours. Retail sentiment toward the stock remained in ‘bearish’ territory while message volume shifted to ‘normal’ from ‘low’ levels in 24 hours.

According to a Reuters report, Intel is facing major obstacles as it tries to regain a leading position in advanced chip manufacturing. Its new 18A chip production method is drawing concern after reports indicated that the company is having trouble producing enough usable chips, putting its upcoming Panther Lake processors at risk.

During the second quarter of 2025, the company recorded a non-cash charge of $797 million due to depreciation and asset impairments tied to manufacturing equipment that is no longer considered usable for current or future production.

This substantial write-off impacted the financial results of the Intel Foundry division. The company also acknowledged that it has yet to land a significant external customer for any of its existing manufacturing nodes.

U.S. Republican Senator Tom Cotton sent a letter on Wednesday to the chair of Intel’s board, raising questions about the company’s new CEO, Lip-Bu Tan, according to a Reuters report.

Cotton was concerned about Tan’s connections to Chinese companies and said that he was worried about the safety and trustworthiness of Intel’s operations.

To make matters worse, President Donald Trump said on Tuesday that Taiwanese chip giant TSMC will invest $300 billion in Arizona.

Intel stock has gained only 0.7% in 2025 and over 1% in the last 12 months.

Also See: Auddia, Match Group, Snap Draw Highest Retail Chatter Among Tech Stocks On Stocktwits: Here’s Why

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)