Advertisement|Remove ads.

Credo Technology Stock Gets An Upgrade At Susquehanna As Stock Halves From Peak: Retail's Extremely Bullish

Credo Technology Group Holding Ltd. (CRDO) stock received a rating upgrade and a price target hike from analysts at Susquehanna even as the company’s shares tumbled nearly 10% in Monday’s regular trade, reeling under a market-wide selloff.

Credo’s shares declined a further 3% during after-market hours.

According to The Fly, Susquehanna upgraded Credo to ‘Positive’ from ‘Neutral’ while maintaining the price target at $60. This implies an upside of over 52% from Monday’s closing price.

Credo’s stock has halved from its 52-week high of $86.69, falling to a four-month low amid a downturn in the broader equity markets triggered by President Donald Trump’s comments about a “disruption” in the U.S. economy due to tariffs.

However, Susquehanna analysts are optimistic about Credo’s prospects, noting that the company’s portfolio of artificial intelligence (AI) products is underappreciated at the stock’s current levels.

Earlier last week, Credo posted its third-quarter results, with earnings and revenue beating Wall Street expectations.

Credo reported earnings per share (EPS) of $0.25, notably higher than the expected $0.18. This is more than six times higher than Credo’s EPS of $0.04 during the year-ago period.

The company’s topline more than doubled during Q3, with revenue coming in at $135 million, beating estimates of $120.36 million. Credo posted revenue of $53.1 million during the same period in the previous year.

Data from FinChat shows an average price target of $82.05 for Credo, implying an upside of more than 51% from Monday’s closing price. Of the 12 analyst recommendations, there are eight ‘Buy’ and four ‘Outperform’ ratings.

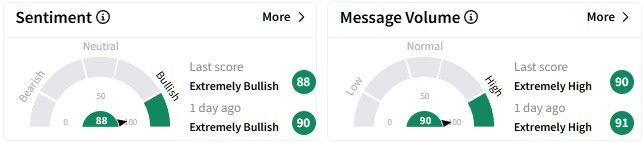

Retail sentiment on Stocktwits around the Credo stock remains exuberant, hovering in the ‘extremely bullish’ (88/100) territory. Message volume was also at ‘extremely high’ levels.

While Credo’s stock has fallen over 44% year-to-date, it has almost doubled over the past year, with gains of 93%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)