Advertisement|Remove ads.

Credo Technology Stock Surges As Q3 Earnings Surpass Expectations: Retail’s Feeling Extremely Bullish

Shares of Credo Technology Group (CRDO) surged more than 7% in Tuesday’s regular trading session after the company’s third-quarter results surpassed expectations.

Credo reported earnings per share (EPS) of $0.25, notably higher than the expected $0.18. This is more than six times higher than Credo’s EPS of $0.04 during the year-ago period.

The company’s topline more than doubled during Q3, with revenue coming in at $135 million, beating estimates of $120.36 million. Credo posted revenue of $53.1 million during the same period in the previous year.

Over the past four quarters, Credo has beaten earnings expectations in all of them, while missing revenue estimates in one.

Driving the surge in Credo’s earnings and revenue was the AEC (active electric cables) segment – the company said it experienced the “inflection point” that it had expected.

“Going forward, we expect continued growth across our product lines and customer base as market demand for innovative connectivity solutions continues to grow,” said CEO Bill Brennan.

For Q4, Credo expects revenue to be between $155 million and $165 million – again, this is higher than the consensus estimate of $136.75 million.

Data from FinChat shows an average price target of $82.33 for Credo, implying an upside of more than 51% from Tuesday’s closing price. Multiple brokerages hiked their price targets for Credo ahead of Q3 results, stating that the surge in AI demand bodes well for the company.

Overall, there are 12 brokerage recommendations, of which seven have a ‘Buy’ rating, four have an ‘Outperform’ call, and one says ‘Hold.’

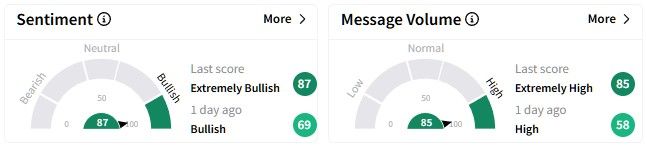

Retail sentiment on Stocktwits around the Credo stock soared, entering the ‘extremely bullish’ (87/100) territory, accompanied by a surge in message volumes.

One user expressed an opinion about Credo’s Q3 performance, adding that the stock could surge anywhere between 10% to 40% on Wednesday or by the end of the week.

Credo’s stock has fallen over 19% year-to-date, but it has more than doubled over the past year, with gains of 152%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219715394_jpg_c787a7b591.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_martin_shkreli_jpg_4da92d4843.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)