Advertisement|Remove ads.

Sunnova Stock Dims After-Hours As Analysts Downgrade On Going-Concern Warning, But Retail Still Sees A Ray Of Light

Shares of Sunnova Energy International Inc. (NOVA) fell more than 3% during after-market trade on Tuesday after analysts at several brokerages downgraded the stock and cut their price target.

According to The Fly, Mizuho downgraded Sunnova stock to ‘Neutral’ from ‘Outperform’ over the going concern language of the company.

The brokerage also cut its price target for the Sunnova stock to $1 from $11, implying an upside of nearly 50% from Tuesday’s closing price.

Mizuho highlighted Sunnova’s going concern warning in the company’s latest 10-K filing with the U.S. Securities and Exchange Commission (SEC.)

Sunnova warned that its cash and credit facilities were “not sufficient to meet obligations and fund operations.”

However, CEO John Berger reassured investors, saying the company has a “solid plan” to address this problem. It has hired a financial advisor to help it with refinancing and debt management.

Analysts at Mizuho noted uncertainty about Sunnova’s cash generation abilities in 2025 even as the company seeks refinancing to address its going-concern issues.

There were also a slew of downgrades from other brokerages, including UBS, Morgan Stanley, Wells Fargo, and Goldman Sachs.

Analysts said that Sunnova’s lack of cash generation guidance remains a “significant headwind” for the stock.

Sunnova and other solar energy companies are facing a possible cut in federal tax credits as the Trump administration settles in.

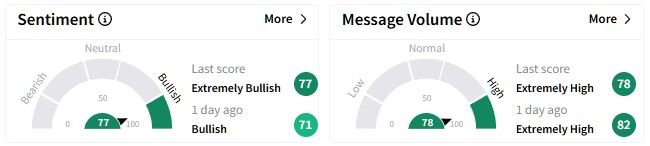

Retail sentiment on Stocktwits around the Sunnova stock soared to enter the ‘extremely bullish’ (77/100) territory, defying downgrades across brokerages.

Message volume remained at ‘extremely high’ levels as retail investors showed interest in the stock amid ongoing concerns.

One user quipped that shorts act like Sunnova’s “bankruptcy is tomorrow.”

Another user said they’re still bullish on the company.

Sunnova’s stock has fallen more than 80% year-to-date, while its one-year performance is worse, with a decline of over 90%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)