Advertisement|Remove ads.

Top 5 S&P 500 Stocks With The Greatest Activity Spike On Stocktwits Ahead Of Thursday

Amid a volatile market environment with President-elect Donald Trump’s cabinet picks, rising geopolitical tensions and Fed policy announcements, five stocks in the S&P 500 have seen a remarkable surge in activity on Stocktwits over the past 24 hours.

This uptick in activity highlights shifting investor sentiment, with key earnings reports and industry news influencing the retail appetite for these names.

As analysts and retail investors digest these developments, these companies stand out as focal points for retail investors on Stocktwits.

Cisco Systems Inc ($CSCO)

Cisco’s stock was down as much as 2% at market open on Thursday after the company reported first-quarter earnings that exceeded analysts’ expectations and raised its full-year forecast but showcased declining revenues.

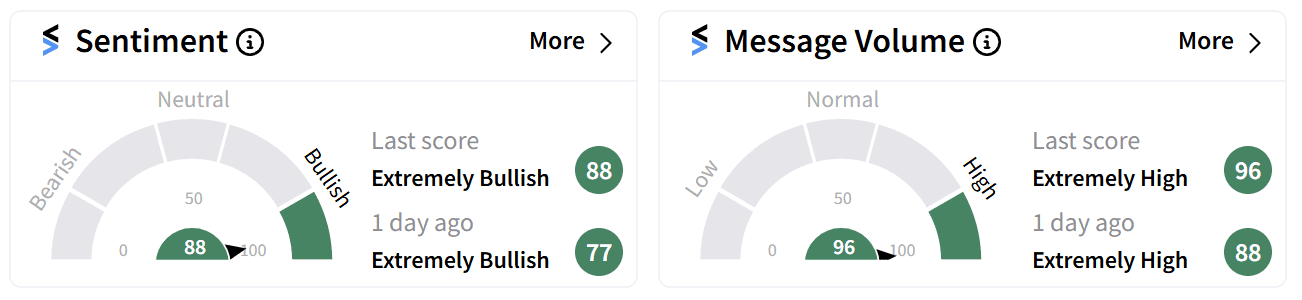

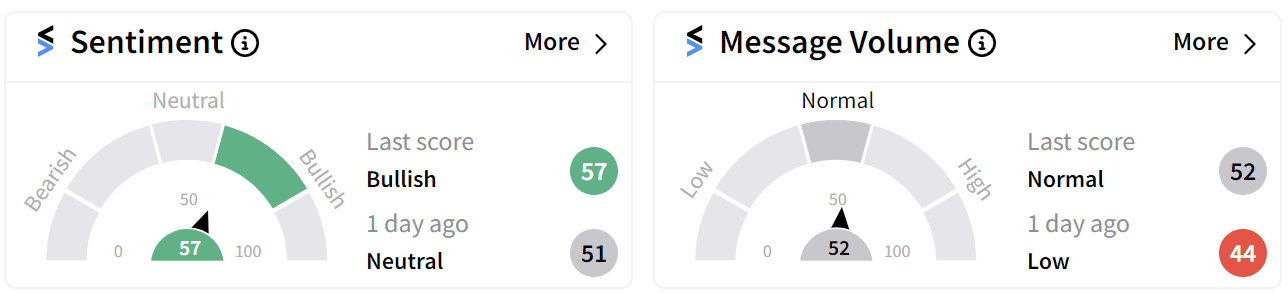

Retail sentiment around the stock continues to be 'extremely bullish' with 'extremely high' chatter.

The stock saw a 1061.91% increase in message volume in the last 24 hours, far outpacing its peers on the S&P 500 index.

The surge in activity was accompanied by a 0.41% increase in watchers to 57,411.

Chevron Corporation ($CVX)

Chevron’s stock was up nearly 1% as markets opened on Thursday after rising more than 2% in the previous session, snapping a two-day losing streak.

The number of watchers on Chevron stock increased by 0.04% to 30,509, alongside a significant 550% surge in message volume.

This spike in interest follows reports that Chevron has resumed production and is bringing back staff to its Gulf of Mexico platforms, which were temporarily shut down due to Hurricane Rafael.

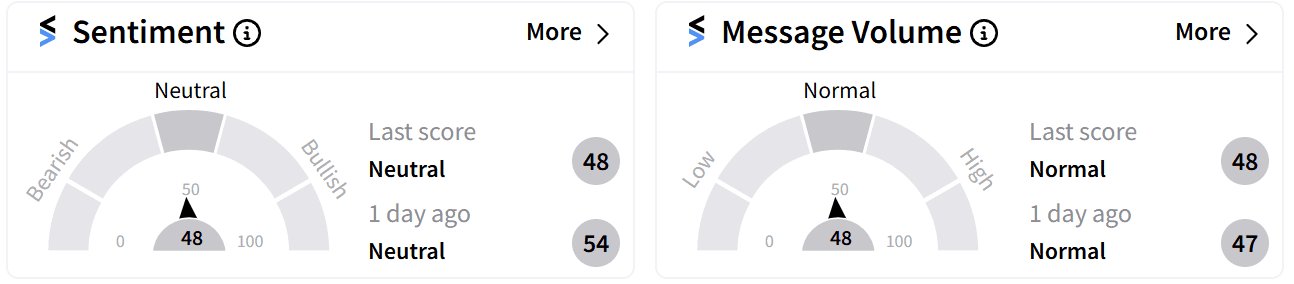

However, retail sentiment around the stock remained subdued in the 'neutral' territory.

Stanley Black & Decker Inc ($SWK)

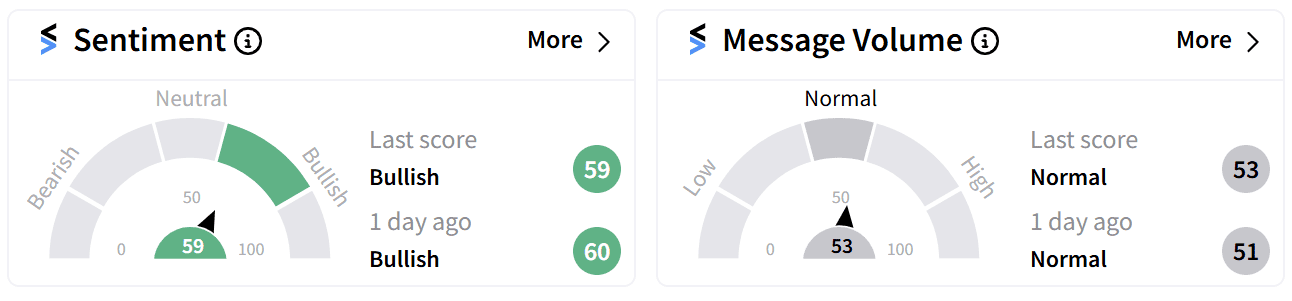

Shares of Stanley Black & Decker were flat as markets opened on Thursday but retail sentiment on Stocktwits remained in the 'bullish' territory.

The industrial tool maker saw a 400% uptick in message volume but saw a 0.08% reduction in watchers on Stocktwits after the company’s CFO hinted that the company may be in the market to sell its aerospace unit.

“You’re a small aerospace business in a world of giants… Is that the one that maybe you either have to get a lot bigger or maybe it will be more valuable to somebody else other than you?” he said at a conference on Tuesday.

The company’s leadership is reportedly looking to lower its debt ratio and trim down its industrial portfolio with the sale.

General Dynamics Corp ($GD)

Shares of General Dynamics were in the red as markets opened on Thursday after the company’s stock soared to an all-time high of $313.39 on Tuesday.

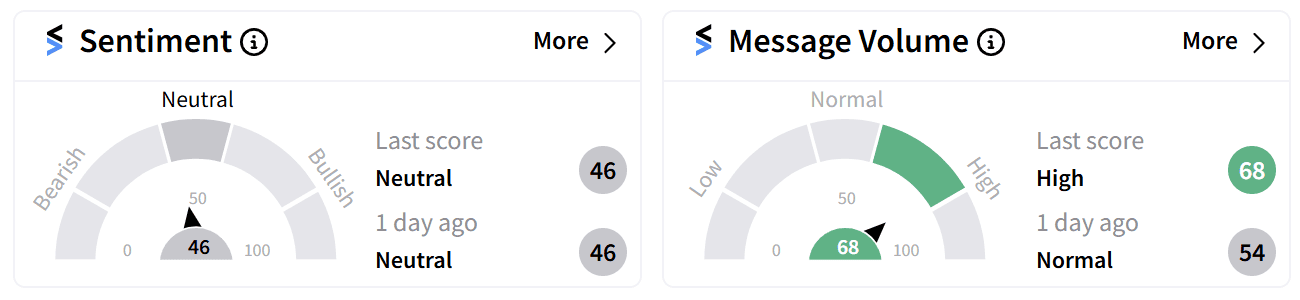

There has been a 400% increase in message volume alongside a 0.04% increase in watchers on Stocktwits. However, retail sentiment remained in the 'netural' zone.

The stock has been benefitting from President-elect Donald Trump’s win in the 2024 U.S. election with the market expecting the company to benefit from an uptick in defense spending under the new administration.

MSCI Inc ($MSCI)

Shares of MSCI rose over 1% as markets opened on Thursday with investors hoping the stock’s break out will extend to $630.

The New York-based investment research company with a focus on ESG saw a 400% increase in watchers alongside a 0.1% increase in watchers.

The uptick comes after Polen capital, an investment management company, highlighted MSCI's recent fourth-quarter earnings beat.

For updates and corrections email newsroom@stocktwits.com.

Read more: Top 5 S&P 500 Stocks Gaining The Most Watchers On Stocktwits Ahead Of Thursday

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)