Advertisement|Remove ads.

Top 5 S&P 500 Stocks Gaining The Most Watchers On Stocktwits Ahead Of Thursday

Amid the market navigating mega events like election, Fed policy announcements and inflation data release, five stocks in the S&P 500 ($SPX) have witnessed a surge in watchers on Stocktwits over the past 24 hours.

As investor sentiment shifts across these companies, this list reflects key developments influencing market perception and retail appetite.

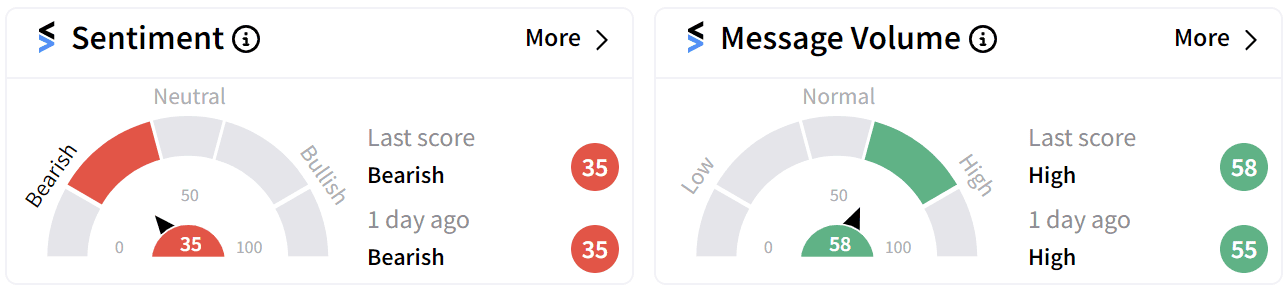

Celanese Corporation ($CE)

Celanese Corporation traded flat in pre-market on Thursday following a 2.26% dip on Wednesday, marking a four-year low of $73.55, a level last seen in May 2020.

The stock topped the S&P 500 in gaining watchers on Stocktwits, rising 1.67% to a follower count of 912.

Investor sentiment has remained bearish due to the company’s earnings miss earlier this week, which was followed by multiple analyst downgrades.

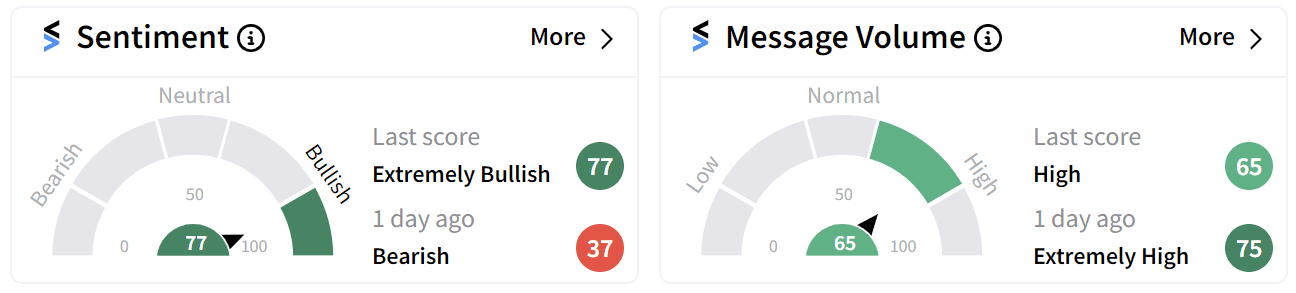

Monolithic Power Systems Inc ($MPWR)

Shares of Monolithic Power saw a slight recovery, rising 0.69% pre-market on Thursday. Watchers on Stocktwits increased 0.97%, bringing the follower total to 1,563.

The company has faced headwinds since an Edgewater Research report suggested that Nvidia cut orders from Monolithic Power for its Blackwell AI chips, citing issues with the company’s power management systems.

Despite the downturn, retail sentiment flipped to ‘extremely bullish’ from ‘bearish’ on Thursday as users saw the price drop as a potential buying opportunity.

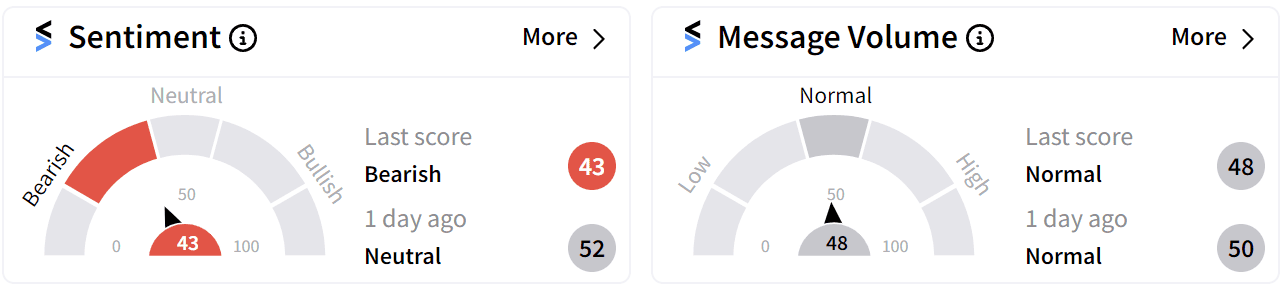

Estee Lauder Companies Inc ($EL)

Estee Lauder gained 0.63% in watchers, reaching 5,265 followers on Stocktwits after the stock hit an 11-year low of $62.29 on Tuesday, a level last seen in April 2013.

The company recently missed revenue estimates, reporting $3.36 billion against Wall Street’s forecast of $3.37 billion, fueling concerns over ongoing leadership and financial instability.

Sentiment around the stock dropped from ‘neutral’ to ‘bearish’ ahead of Thursday's session.

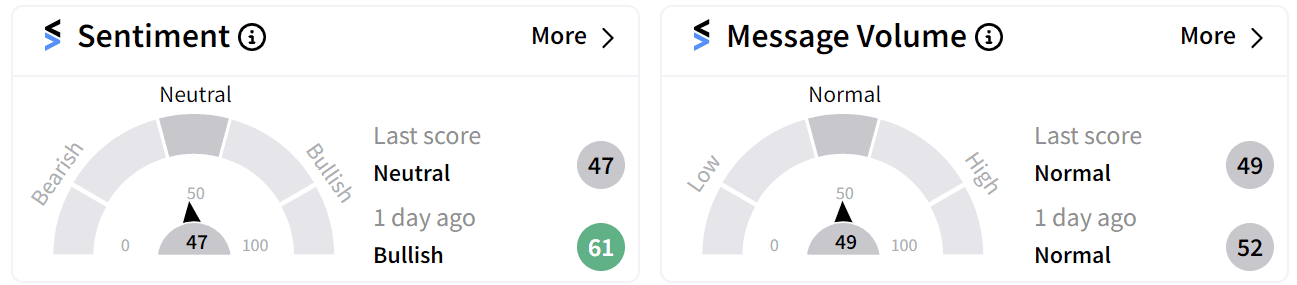

Bath & Body Works Inc ($BBWI)

Shares of Bath & Body Works traded flat pre-market on Thursday, while watchers on Stocktwits rose by 0.54%, totaling 1,119.

The increased interest follows the company’s recognition by the ESG & Sustainability Awards for its ESG Report of the Year.

However, sentiment dipped to ‘neutral’ from ‘bullish’ amid controversy over a holiday candle release, which has faced backlash after customers drew comparisons to the KKK hood.

Rockwell Automation Inc ($ROK)

Shares of Rockwell Automation remained flat in pre-market trading on Thursday, while watchers on Stocktwits climbed by 0.53% to 2,100.

The rise comes after UBS downgraded Rockwell from ‘Buy’ to ‘Neutral,’ setting a price target of $313.

This follows mixed reactions from other brokerages regarding Rockwell’s 21% year-on-year sales decline in its fourth-quarter earnings results last week.

For updates and corrections email newsroom@stocktwits.com.

Read more: Top 5 S&P 500 Stocks With The Greatest Activity Spike On Stocktwits Ahead Of Thursday

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)