Advertisement|Remove ads.

Cummins India Maintains Uptrend: SEBI RA Deepak Pal Sees Room For Gains Till ₹3,550

Cummins India is currently displaying strong bullish momentum on the daily chart, according to SEBI-registered analyst Deepak Pal.

After a brief correction earlier in the week, the stock has managed to stay above its 14-day exponential moving average (EMA) for the last two sessions, Pal noted. The stock has consistently traded above its 55-day and 200-day EMAs for more than a year, highlighting its sustained long-term strength.

On June 24, Cummins India stock touched a low of ₹3,282.70, followed by a slightly lower low of ₹3,278.50 the next day, before closing at ₹3,318.90. Today, it opened at ₹3,319.90 and is currently trading at ₹3,370, signifying buying interest.

Notably, the stock rebounded from a low of ₹1,659.10 on November 1, 2023, reinforcing the strength of its key support zone.

In the short term, Pal sees ₹3,290 as a critical support level. If current momentum continues, the stock may soon approach the ₹3,500–₹3,550 zone, a 5% premium to the current share price.

Adding to the positive sentiment, the company has recently launched its Battery Energy Storage System (BESS), which aims to support clean energy integration and reduce carbon emissions.

From a fundamental perspective, the company reported a 6.4% year-on-year revenue growth in Q4 FY24-25 to ₹2,414 crore, despite a marginal 1.7% decline in net profit to ₹530 crore.

Cummins India is a key player in engines and power solutions with a strong presence across industrial, automotive, construction, and mining sectors. With its low debt, ROE of 18–20%, consistent dividends, and improving margins, the company is well-positioned to benefit from India’s infrastructure and industrial growth.

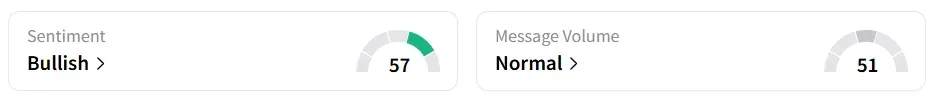

On Stocktwits, retail sentiment turned ‘bullish’ from ‘neutral’ a day earlier.

The stock has gained 2.8% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)