Advertisement|Remove ads.

CVS Stock Rises, Grabs Retail Attention After Report Of Potential Breakup

Shares of CVS Health Corp. (CVS) climbed nearly 2% pre-market on Tuesday, following a rise in the previous session, pushing them into the list of top 10 trending tickers on Stocktwits.

The surge came after the Wall Street Journal reported that CVS has been evaluating options, including a potential breakup of the company. The report noted that CVS’s board has tapped bankers for advice on the matter, though no final decision has been made.

Deutsche Bank responded to the news, remarking that the report “has the smell of desperation.” The brokerage questioned whether CVS management was involved in the process and highlighted that activist hedge funds have reportedly taken positions in the company, advocating for significant changes.

Deutsche maintained a ‘Hold’ rating on CVS with a $63 price target, expressing doubts about how much value could be salvaged in the short to medium term given CVS’s execution challenges.

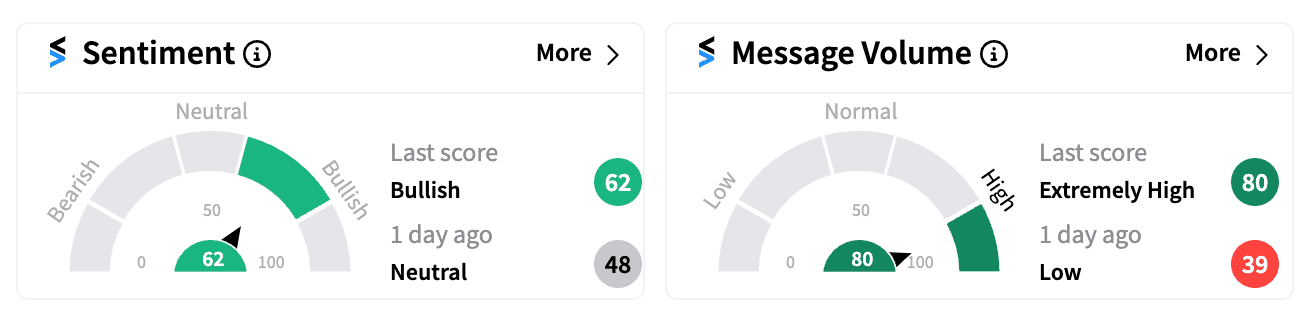

Retail investors reacted swiftly to the news, with message volume on Stocktwits for CVS jumping 133% on Monday alone.

Sentiment shifted from ‘neutral’ to ‘bullish’ as investors speculated on the attractiveness and the potential for value in the stock.

CVS has returned $3.1 billion to shareholders through dividends in 2023, and $2.9 billion the year before.

But its stock has dropped more than 20% year-to-date amid falling profit margins in the company’s retail pharmacy business and higher patient care costs from its Aetna unit, which rakes in more than 30% of total revenue.

Earlier in August, CVS cut its 2024 earnings forecast for the third consecutive quarter, hit by surging medical costs and lower Medicare reimbursement levels.

Earlier on Monday, reports had also suggested that Glenview Capital Management, a major CVS shareholder, met with company executives to discuss ways to revive its financial performance.

Read next: Carnival Gets Price-Target Hikes After Q3 Earnings: Stock Rises, Retail Sentiment Near Year’s High

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)