Advertisement|Remove ads.

CVS, Walgreens To Buy Pharmacy Assets From Rite Aid Corp: Retail Sentiment Brightens

Drugstore chain Rite Aid Corporation said on Thursday that it has agreed to sell pharmacy assets from more than 1,000 store locations across the U.S. to operators including CVS Pharmacy (CVS), Walgreens (WBA), Albertsons, Kroger, and Giant Eagle, among others.

The company said it has also sold many drug stores located in Washington, Oregon, and Idaho to CVS Pharmacy. While Rite Aid owned some of these drug stores, others were owned by its wholly-owned unit, Bartell Drugs.

The company said the stores will remain open during the transition, and customers can continue to access pharmacy services.

Rite Aid's Chief Executive Officer, Matt Schroeder, said the agreements will ensure a smooth transition experience for its customers while also preserving jobs for some of its team members.

However, the transactions must be approved by the U.S. Bankruptcy Court for the District of New Jersey, and it is currently scheduled to conduct a hearing to approve the sales on May 21, 2025.

Rite Aid first filed for bankruptcy in late 2023 owing to a massive debt pile. The company recently filed for bankruptcy again to resolve its long-term challenges.

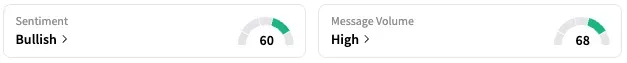

On Stocktwits, retail sentiment around CVS Health Corp, parent of CVS Pharmacy, rose from ‘neutral’ to ‘bullish’ over the past 24 hours while message volume remained at ‘high’ levels.

As for Walgreens, retail sentiment around parent company Walgreens Boots Alliance Inc. rose from ‘bearish’ to ‘neutral’ over the past 24 hours, coupled with ‘high’ message volume.

While CVS stock is up by about 37% this year, WBA stock is up by about 22%.

Also See: Seagate Bull Flags 3 Key Things To Watch For At Next Week’s Analyst Event: Retail Mood Muted

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)