Advertisement|Remove ads.

Cyngn Stocks Soars On Nvidia Partnership, Robotics Showcase

Shares of autonomous vehicle tech company, Cyngn Inc. (CYN) are soaring after the company announced it is joining forces with Nvidia Corp.(NVDA) to demonstrate autonomous technology at Automatica 2025, an event dedicated to robotics and smart automation.

The partnership highlighted how Cyngn is using the Nvidia Isaac robotics platform to enhance its self-driving vehicle solutions for industrial use cases.

Cyngn stock was up more than 276% at the time of writing, paring some gains.

As noted in a recent blog post by Nvidia, Cyngn was highlighted as one of the select few companies advancing real-world autonomy with Isaac-based innovations.

Cyngn is incorporating its DriveMod system into Nvidia’s Isaac Sim platform to facilitate extensive, high-precision simulation of complex self-driving capabilities.

Designed specifically for industrial use, DriveMod is currently integrated into vehicles like the Motrec MT-160 Tugger and BYD Forklift, where it brings advanced automation to material transport workflows.

The collaboration is on display at Automatica 2025 in Munich, Germany, where the world’s top robotics minds will explore the evolving impact of AI on manufacturing and logistics processes.

The use of Nvidia Isaac provides Cyngn’s industrial vehicles with access to accelerated computing, simulation, and sensor integration.

In the first quarter (Q1), Cyngn rolled out its DriveMod-enabled Tuggers and Forklifts to support operations in various sectors such as Manufacturing, Logistics, Consumer Packaged Goods, and Defense.

In Q1 of 2025, Cyngn’s revenue grew over seven times to $47,152, with net loss per share of $6.60. The company held about $1 million in cash and equivalents as of March 31.

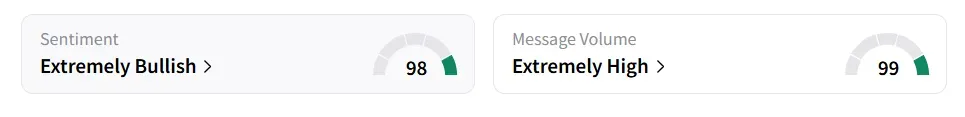

On Stocktwits, retail sentiment around Cyngn improved to ‘extremely bullish’ from ‘neutral’ the previous day. The message volume saw a massive jump to ‘extremely high’ from ‘normal’ levels in 24 hours.

Cyngn stock has lost over 85% year-to-date and over 98% in the last 12 months.

Also See: Micron Stock On Track To Hit Year High After Q3 Earnings Beat Sparks Wave Of Price Target Hikes

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)