Advertisement|Remove ads.

D-Mart Shares: SEBI RA Mayank Singh Chandel Suggests Wait & Watch Until Breakout Above ₹4,550

D-Mart parent Avenue Supermarts's shares traded 1% lower in afternoon trade on Monday as a weak operational performance in the fourth quarter weighed on investor sentiment.

The company posted a 16.8% rise in consolidated revenue to ₹14,872 crore, but net profit slipped 2.2% to ₹551 crore.

Operating profit (EBITDA) barely moved and EBITDA margins shrank to 6.4% from 7.4% year-on-year — reflecting cost pressures and intensifying competition in the FMCG space.

SEBI-registered analyst Mayank Singh Chandel highlighted that despite growing store presence and rising footfalls, average customer spends have declined, signaling potential challenges in driving profitability.

On the technical front, Chandel notes that while sales growth remains strong, the stock looks weak on the charts.

DMart stock is trading below its 50-day EMA, indicating weakness, with resistance in the ₹4,350–₹4,550 range and key support at ₹3,750 and long-term support between ₹3,310–₹3,350.

The Relative Strength Index (RSI) is around 40, suggesting bearish momentum but not yet oversold.

Chandel believes DMart remains a fundamentally strong business with robust sales growth, but advises caution due to falling profits and weak price action.

He suggests waiting for a decisive close above ₹4,550 with strong volume before considering a buy, and warns that a drop below ₹3,750 could see the stock fall further toward ₹3,350. For now, patience is recommended until a clear technical signal emerges.

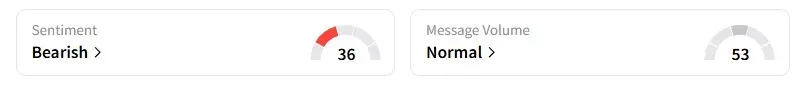

Data on Stocktwits shows that retail sentiment for DMART stock has turned ‘bearish’ versus ‘neutral’ a week ago.

DMart shares gained 13% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)