Advertisement|Remove ads.

Dan Ives Brushes Aside Tesla’s Weak Q2, Says Will Buy TSLA Stock On Weakness: ‘This Is An AI Story’

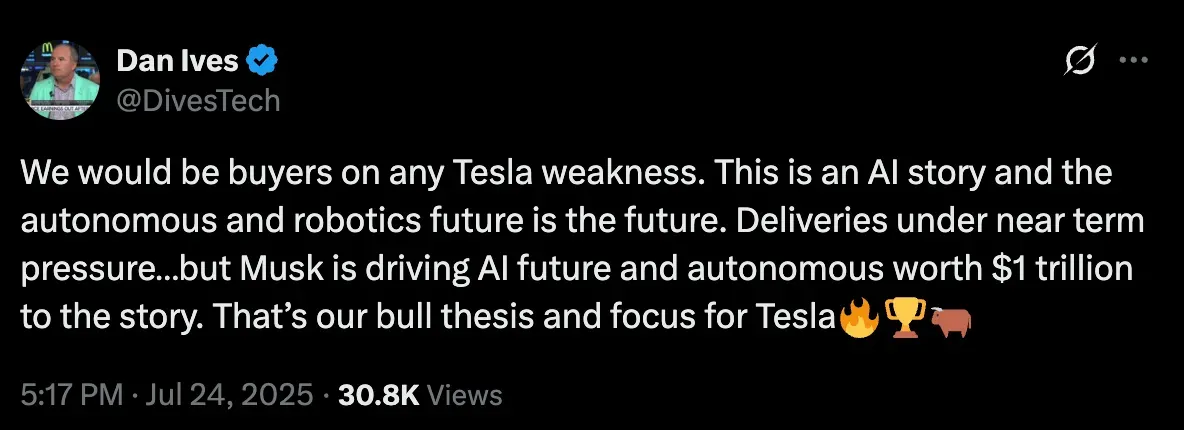

Tech bull Dan Ives on Thursday brushed aside concerns around the Tesla stock, saying Wedbush would scoop up shares of the company on any weakness.

Tesla shares were down more than 6% at the time of writing during Thursday’s pre-market session. Stocktwits data showed the retail sentiment around the TSLA stock was in the ‘bearish’ territory.

Explaining his stance, Ives said Tesla is an AI story, with autonomous driving and robotics being the future.

“Deliveries under near term pressure…but Musk is driving AI future and autonomous worth $1 trillion to the story. That’s our bull thesis and focus for Tesla,” he said in a post on X.

Ives’ comments follow Tesla's announcement of its second-quarter (Q2) results on Wednesday, which reported the second consecutive quarterly decline in sales revenue.

Tesla’s earnings per share (EPS) stood at $0.4, while the Street expected $0.41, according to Stocktwits data. The EV giant’s revenue in Q2 stood at $22.5 billion, edging past an expected $22.13 billion, according to Fiscal.ai data.

For context, Tesla’s EPS in the same quarter a year earlier was $0.52 on a revenue of $25.5 billion.

Tesla’s deliveries declined to 384,112 in Q2, down from 443,956 during the year-ago period.

Tesla CEO Elon Musk warned that the company may face a challenging time in the near term. “We probably could have a few rough quarters. I am not saying that we will, but we could,” Musk said.

TSLA stock is down 18% year-to-date, but up 54% over the past 12 months.

Get updates to this developing story directly on Stocktwits.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)