Advertisement|Remove ads.

Dan Ives Calls Nvidia The Bedrock Of The AI Revolution Ahead Of Q3 Report

- Ives said Nvidia CEO Jensen Huang occupies a uniquely privileged position to comment on surging demand for AI hardware.

- Nvidia is expected to report third-quarter earnings after market close on Wednesday.

- Nvidia’s cumulative order backlog exceeded $500 billion for its Blackwell and Rubin platforms in 2025 and 2026.

Dan Ives, managing director at Wedbush Securities, proclaimed on Wednesday that NVIDIA Inc. (NVDA) is the sole company forming the foundation for the AI revolution, ahead of the chip giant’s earnings.

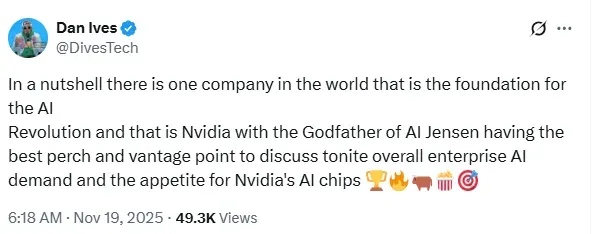

In a post on X, Ives expressed optimism about the AI bellwether’s upcoming earnings report and its CEO, Jensen Huang.

“In a nutshell there is one company in the world that is the foundation for the AI Revolution and that is Nvidia,” Ives said in the post.

Big Bet on Enterprise AI

Ives stated that Nvidia’s CEO Jensen Huang occupies a uniquely privileged position to observe and comment on surging demand for enterprise-grade AI hardware.

Nvidia has a dominant architecture and a large developer ecosystem. Its long-standing relationships with cloud providers give Nvidia a competitive edge that few rivals can match, especially in the enterprise AI space.

Third-quarter Expectations

According to Fiscal AI data, analysts expect Nvidia to post a Q3 revenue of $54.8 billion and earnings per share (EPS) of $1.25.

Nvidia’s CEO Jensen Huang has said that the company’s cumulative order backlog exceeded $500 billion for its Blackwell and Rubin platforms in 2025 and 2026.

Nvidia’s stock traded over 1% higher in Wednesday’s premarket. On Stocktwits, retail sentiment around the stock jumped to ‘bullish’ from ‘neutral’ the previous day, amid ‘high’ message volume.

Nvidia is scheduled to report earnings in a volatile environment, as big tech companies’ capital expenditure spirals to ramp up AI infrastructure, prompting investors to be cautious about valuations.

NVDA stock has gained 35% year-to-date and over 23% in the last 12 months.

Also See: Jefferies Upgrades DoorDash To Buy, Sees 23% Upside Amid Recent Pullback

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)