Advertisement|Remove ads.

Dan Ives Claps Back At ‘AI Bubble’ Bears, Says Tech Capex Supercycle Is Just Beginning

- Ives expressed optimism that the technology capital expenditure “supercycle” will continue to drive the fourth industrial revolution over the next few years.

- The analyst expects the tech bull market to have two more years of runway, stating that Wall Street is “underestimating” the AI-led boom in equities.

- He called out bears, saying that they have never understood this tech AI-driven bull market since early 2023.

Dan Ives, Global Head of Tech Research at Wedbush, on Wednesday clapped back at bears on Wall Street for voicing concerns about a potential “AI bubble.”

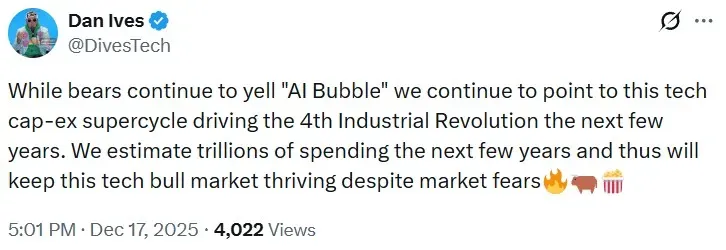

In a post on X, Ives expressed optimism that the technology capital expenditure “supercycle” will continue to drive the fourth industrial revolution over the next few years.

“We estimate trillions of spending the next few years and thus will keep this tech bull market thriving despite market fears,” he said.

Surging AI Capex

BlackRock stated in its 2026 whitepaper that it expects AI capex to range between $5 trillion and $8 trillion globally by 2030. “The AI buildout could be faster and greater than all past technological revolutions,” the firm stated.

The asset manager added that it sees AI capex supporting U.S. growth in 2026. It expects AI capital spending’s contribution to the economic growth of the U.S. to be three times its historical average next year.

“This capital-intensive boost is likely to persist into next year, allowing growth to hold up even as the labor market keeps cooling,” it said.

Bull Market’s Legs

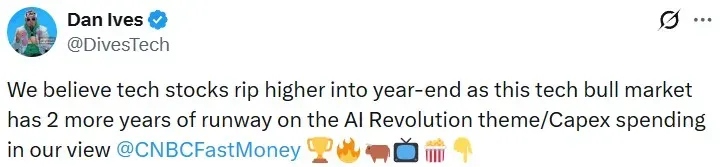

Earlier, Ives said in a post on X that he expects the tech bull market to have two more years of runway.

In a separate post, Ives said bears have “NEVER understood this tech AI-driven bull market since early 2023.” He added that Wall Street is “underestimating” the boom in U.S. equities driven by AI.

Meanwhile, U.S. equities declined in Wednesday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was down by 0.14%, the Invesco QQQ Trust ETF (QQQ) fell 0.36%, while the iShares US Technology ETF (IYW) was down by 0.52%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

NVDA stock is up 32% year-to-date and 35% in the past 12 months.

Also See: Ford Terminates $6.5 Billion LG Energy Deal After Retreating From EVs — And Retail Is Split

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213366819_jpg_3e8b649e98.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_rising_OG_jpg_5f141f956f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_vertex_logo_resized_4070318817.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_shell_resized_jpg_161ef0a394.webp)