Advertisement|Remove ads.

Datadog Draws Wall Street’s Praise Ahead Of Q3 Earnings

Datadog Inc. (DDOG) has received Wall Street’s endorsement as Oppenheimer and TD Cowen have raised their price targets ahead of the company’s upcoming third-quarter (Q3) earnings report, signaling confidence in its performance and market position.

Oppenheimer lifted its price target to $195 from $165, maintaining an ‘Outperform’ rating, according to TheFly. The firm expects companies in the analytics, data, infrastructure, and security software sectors to post revenue growth and slightly higher guidance for the full year.

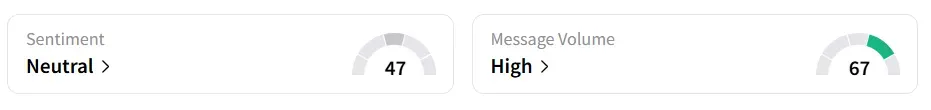

Datadog stock traded over 2% higher on Friday, after the morning bell. On Stocktwits, retail sentiment around the stock improved to ‘neutral’ from ‘bearish’ territory the previous day. Message volume shifted to ‘high’ from ‘normal’ levels in 24 hours.

The stock experienced a 771% increase in user messages over 24 hours.

Oppenheimer also highlighted steady Q3 activity, an encouraging Q4 pipeline, and manageable competition in the space.

TD Cowen raised its target, moving it to $180 from $175 while reiterating a ‘Buy’ rating. Analyst Andrew Sherman noted that the firm anticipates results surpassing guidance by roughly 23%.

He added that concerns around Observability and AI have waned, helping boost investor sentiment. Cowen’s internal sales tracking shows a healthy hiring trend, suggesting greater capacity in the second half of the year.

Sherman emphasized that a visible traction in Datadog’s core business would help strengthen investor confidence heading into the FY26 outlook.

On Thursday, a report suggested that Datadog was exploring a fresh takeover bid for GitLab. Datadog is a provider of cloud applications monitoring and security platform.

Datadog stock has gained over 7% year-to-date and over 21% in the last 12 months.

Also See: SEALSQ Stock Just Shot Up 10% Today: What’s Driving The Rally?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246906030_jpg_5d1c52da00.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246745935_jpg_973c37103a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tim_cook_OG_jpg_08b852f801.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)