Advertisement|Remove ads.

Dave & Buster’s Sees Wall Street Downgrades, Yet Retail Sentiment Red-Hot

Dave & Buster's Entertainment (PLAY) was among the top five losers on Stocktwits after multiple price target cuts from Wall Street following its second-quarter sales, which were pressured due to a difficult macro environment and challenges related to the brand.

Shares of the company were down nearly 17% before the bell on Tuesday after Dave & Buster’s missed quarterly results. UBS cut its price target on Dave & Buster's to $25 from $29 and maintained a ‘Neutral’ rating, according to TheFly.

The firm said that Dave & Buster's second-quarter results included still pressured sales trends, likely given a difficult macro and brand-specific challenges, while margins and earnings were also depressed.

UBS noted that while the company is still in the early stages of a turnaround, with macro pressure remaining elevated and visibility limited, an eventual return to consistently positive same-store sales represents potential upside for shares.

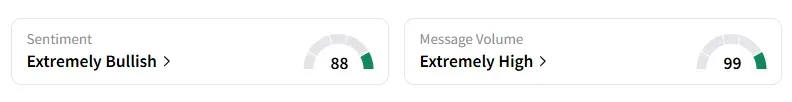

The retail user message count on the stock jumped 5,200% in the last 24 hours on Stocktwits. Retail sentiment remained unchanged in the ‘extremely bullish’ territory, with message volumes at ‘extremely high’ levels, according to data from Stocktwits.

Truist Securities cut its price target on Dave & Buster's to $22 from $27 and maintained a ‘Hold’ rating. The firm said that the company's same-store sales decelerated in the back half of the quarter despite much easier year-ago compares as growing macro headwinds offset recent gains from its "back to basics" approach.

Brokerage Truist Securities noted that while it sees incremental sales drivers in the second half of 2025, it also sees a risk that consumer pressures mount. Piper Sandler lowered its price target on Dave & Buster's to $26 from $30 and maintained a ‘Neutral’ rating, according to TheFly.

A bearish user on Stocktwits noted that there was “no upward catalyst” until the next earnings.

Shares of Dave & Buster’s have declined over 17% this year and lost nearly a quarter of its value in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: United Airlines To Hire 2,500 Employees At Newark Airport

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)