Advertisement|Remove ads.

Deckers Stock Slips On Weak Q1 Outlook, FY Guidance Suspension — But Retail Cheers ‘Sound’ Q4 Print

Deckers Outdoor (DECK) on Thursday issued a first-quarter forecast that missed Wall Street expectations and skipped offering guidance for its current fiscal year, dragging its shares down 15% in extended trading.

The sports products company also increased the quantum of a previously announced buyback plan to $2.5 billion from $2.25 billion.

"Given the macroeconomic uncertainty related to evolving global trade policies, the Company will not be providing full year guidance for fiscal year 2026 at this time," the company said, adding it might skip issuing quarterly guidance as well.

On the analyst call, management estimated an additional $150 million cost due to tariffs in fiscal 2026.

Deckers sells footwear and sports products under brands such as UGG, HOKA, and Teva and relies on imports from China, Vietnam, Cambodia, and Indonesia, among other countries.

As of writing, Deckers was among the top 20 trending tickers on Stocktwits.

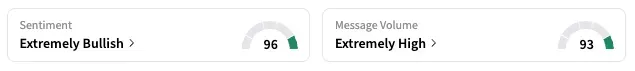

On the platform, retail sentiment climbed to 'extremely bullish' territory, and message volume jumped to 'extremely high.'

With Deckers reporting Q4 revenue and profit higher than estimates, some users pointed out that the business is sound and the tariff pressures might go away sooner or later.

"Fundamentally, this doesn't change the company's sound business model and strong products," said one user.

Another user lauded the increase in buyback amid a low share price, calling it the "Most brilliant move I've ever seen."

Deckers set fiscal Q1 EPS guidance of $0.62 to $0.67 on sales of $890 million to $910 million. Analysts expected an EPS of $0.79 on sales of $925.3 million, per FactSet.

In Q4, it earned $1 per share, on an adjusted basis, on sales of $1.02 billion. Analysts had expected $0.64 EPS and $1.01 billion in revenue.

Deckers' shares are down 38% year to date as of their last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)