Advertisement|Remove ads.

Deckers Stock Sparks 'Extremely Bullish' Buzz On Stocktwits After CEO Flags Strategic Reset

Deckers Outdoor (DECK) CEO Stefano Caroti stated that the sportswear company has identified some of the execution challenges over the past six months and is rolling out strategic adjustments, including wider spacing between major franchise launch dates and stricter inventory controls on outgoing models ahead of product refreshes.

“We're implementing changes that include adjusting product life cycles to ensure a steady and balanced introduction of new products across key categories, timed to coincide with major shopping periods,” Caroti said on a post-earnings call.

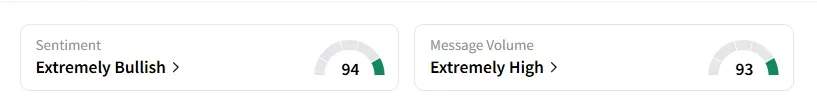

The retail user message count on the stock jumped 1,350% in the last 24 hours on Stocktwits. Retail sentiment on Deckers improved to ‘extremely bullish’ from ‘neutral’ a day ago, with chatter levels being ‘extremely high,’ according to data from Stocktwits.

DECK sentiment and message volume July 25, 2025, as of 09:35 am ET | Source: Stocktwits

Shares of Deckers surged about 14% in early trading after it beat first-quarter results, driven by strong international demand for its Hoka shoes and UGG boots.

Heading into the quarter, analysts had raised concerns about the softness in the direct-to-consumer channel for Hoka, which could become a significant headwind for investors. Hoka, along with Roger Federer-backed On Holding’s Cloudmonster, had been gaining market share in the running shoes category and competing highly with Nike (NKE).

Key franchises of Hoka, namely Bondi, Clifton, and Arahi, continued to outperform, highlighted by record sell-throughs and global demand, with Bondi and Clifton maintaining their positions as the top two running franchises in the U.S., according to Telsey Advisory Group analyst Dana Telsey.

Deckers plans to phase in product price increases over the course of fiscal 2026 to offset the higher costs associated with tariffs.

Taking into consideration the recent update of a 20% tariff on Vietnam, Deckers has now forecast a $185 million rise in costs of goods sold in fiscal 2026, CFO Steven Fasching said. The company had earlier forecast $150 million in May.

Caroti added that since increasing prices on July 1, the company has not seen any material decline in performance for the products on which prices have been raised.

Deckers' stock has lost nearly 42% of its value year-to-date and declined 21% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)