Advertisement|Remove ads.

Dell Pushes Back ‘Project Maverick’ AI Overhaul By Three Months: Report

- Project Maverick aims to simplify Dell’s IT architecture to support its AI strategy.

- BofA trimmed its 12-month price objective for Dell to $160 from $170.

- Analysts expect third-quarter revenue of $27.29 billion and earnings per share of $2.48.

Dell Technologies (DELL) has reportedly postponed the rollout of its secretive internal overhaul initiative, codenamed ‘Project Maverick’, pushing key deployment dates by three months.

Maverick aims to simplify Dell’s IT architecture to support its AI strategy.

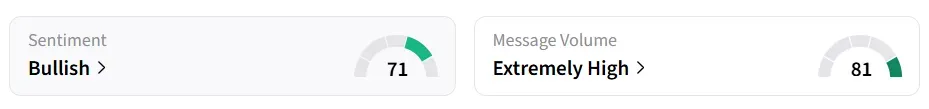

Dell stock traded over 2% higher in Thursday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘extremely high’ message volume levels.

Timeline Revision

According to an internal memo seen by Business Insider, Dell’s vice chairman and COO, Jeff Clarke, said the transition for its client solutions division will now begin in May 2026, while the infrastructure solutions business is set for August 2026.The overhaul was initially planned for February 2026 and May 2026.

Clarke noted that while internal testing shows the new system works, it’s ‘not yet ready to scale’ globally. He emphasized the need for more thorough performance evaluation under real-world loads before a full launch, cited the report.

Dell’s IT infrastructure currently runs on roughly 4,700 applications, more than 10,000 databases, and 70,000 servers.

BofA Cuts Price Target

On Thursday, BofA trimmed its 12-month price objective for Dell to $160 from $170, while maintaining a Buy rating ahead of Dell’s third-quarter earnings on November 25, according to TheFly.

According to BofA, Dell’s third-quarter results are expected to match its own guidance and Wall Street projections roughly. Looking ahead to the fourth quarter, BofA models a modest dip in earnings per share (EPS) of about 1 cent, driven by higher memory costs.

For Q3, analysts expect a revenue of $27.29 billion and EPS of $2.48, according to FiscalAI data.

DELL stock has gained over 3% in 2025 and declined over 10% in the last 12 months.

Also See: Rocket Lab Plans Second Mission In 48 Hours – RKLB Stock Rises Premarket

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)