Advertisement|Remove ads.

Devon Energy, Coterra Energy Reportedly Hold Merger Talks

- The terms and structure of the deal are still being negotiated with no certainty that the talks will result in an agreement, as per the report.

- Coterra has also explored merger talks with at least one other company in the recent past and other suitors for the deal could also emerge, as per the people cited in the report.

- Coterra and Devon’s merger would result in an agreement that would be among the largest U.S. energy deals in recent years.

U.S. shale producers Devon Energy Corp. (DVN) and Coterra Energy Inc. (CTRA) are reportedly considering a merger deal that could be one of the largest energy deals in recent history.

According to a report from Bloomberg on Thursday that cited people familiar with the matter, the companies are engaged in discussion about a potential merger, with an all-stock deal being one of the options being considered.

The terms and structure of the deal are still being negotiated, with no certainty that the talks will result in an agreement, as per the report. Coterra has also explored merger talks with at least one other company in the recent past and other suitors for the deal could also emerge, as per the report.

Shares of DVN declined over 2% on Thursday while shares of CTRA climbed over 3% at the time of writing.

Mega-Deal Possibility

Coterra’s merger with Devon would result in an agreement that would be among the largest U.S. energy deals in recent years.

The possible deal comes on the heels of pressured U.S. crude prices amid a global supply glut, pushed on further by the geopolitical volatility of Venezuela’s re-entry into oil the market after years.

Both Devon and Coterra have significant operations across many shale formations in the U.S., with large positions in the key Permian Basin in Texas.

As per the Bloomberg report, Devon has roughly 400,000 net acres in the Permian’s Delaware Basin while Coterra has 346,000 acres in the same region. A merger between the two could be significant and position the company better to compete with oil behemoths like Exxon Mobil Corp. (XOM) and Diamondback Energy Inc. (FANG).

What Are Stocktwits Users Saying?

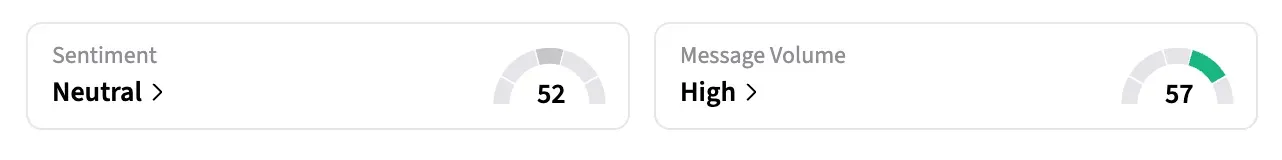

On Stocktwits, retail sentiment around DVN stock remained in the ‘bullish’ territory over the past day amid ‘high’ message volumes.

Meanwhile, retail sentiment around CTRA stock jumped to ‘neutral’ from ‘bearish’ territory amid ‘high’ message volumes.

Shares of DVN have lost over 5% in the past year while shares of CTRA have declined over 10% in the same time.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)