Advertisement|Remove ads.

DexCom Crashed 40% In A Single Day Last Week; Gains 19% More Stocktwits Watchers

DexCom, a manufacturer of glucose monitoring systems for diabetes management, witnessed a 19% rise in the number of watchers on Stocktwits over the last week. The renewed interest in the stock came after the firm surprisingly trimmed its full-year sales forecast, a move that immediately pushed its shares down by 40%.

The firm now anticipates full-year revenue of $4.00-$4.05 billion versus an earlier guidance of $4.20-$4.35 billion. Analysts did not take the significant revision lightly and raised concerns during the earnings call. DexCom management cited factors like sales force disruption and a decline in market share as some of the primary reasons that led to the guidance trim.

Meanwhile, the company reported a 15% rise in its second quarter revenue at $1 billion while net income rose 24%YoY to $143.50 million. Volume growth in conjunction with strong new customer additions continued to be the primary driver of revenue growth.

The firm’s sensor segment witnessed a 22% YoY rise in revenue at $947 million while hardware revenue declined 39% to $57.30 million.

Kevin Sayer, Dexcom’s chairman, president and CEO stated that the firm’s execution did not meet its high standards. The firm cited a decline in new customers, lower revenue per patient and higher-than-expected rebates as reasons for its sales guidance cut.

Meanwhile, JPMorgan downgraded the stock to ‘Neutral’ from ‘Overweight’ while reducing the price target to $75 from $145. The firm’s analyst said the second-quarter update was a sharp turn in the wrong direction for the firm.

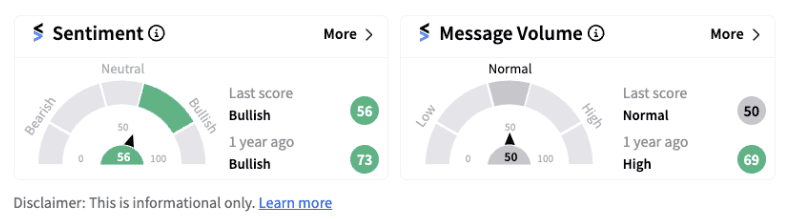

However, retail sentiment is currently trending in the bullish territory (56/100) as investors’ confidence was buoyed by the firm’s $750 million share repurchase program.

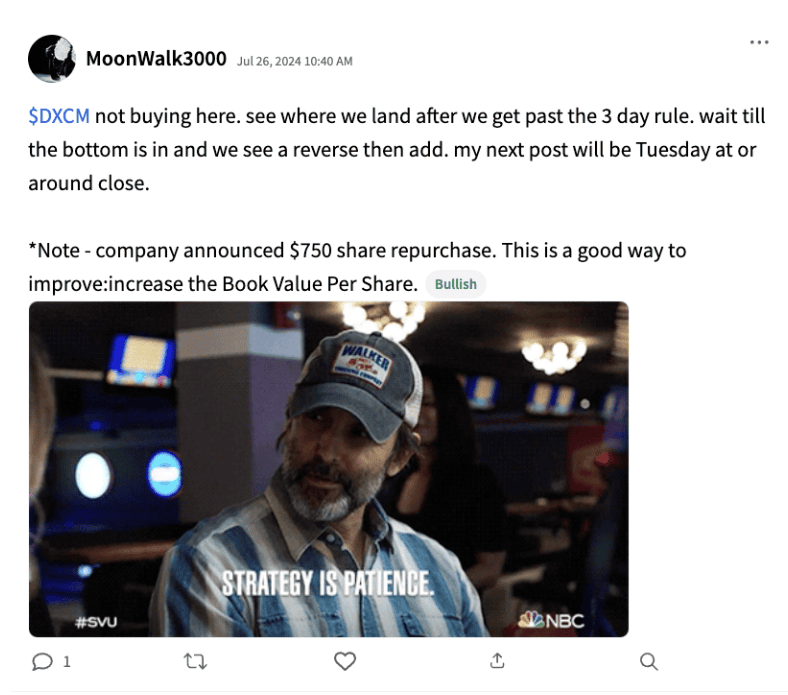

DexCom hasn’t recovered from the 40% decline but retail investors anticipate the share repurchase may help in recouping some of the losses. One Stocktwits user named ‘MoonWalk3000’ expressed optimism about the company’s buyback decision and said this is a good way to improve the book value of the stock.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)