Advertisement|Remove ads.

Disney's Retail Buzz Builds Ahead Of Earnings: What Analysts Are Expecting

Shares of Walt Disney Co. ($DIS) rose over 1% on Wednesday afternoon as the entertainment giant prepares to report its fiscal fourth-quarter (Q4) results before Thursday’s market open.

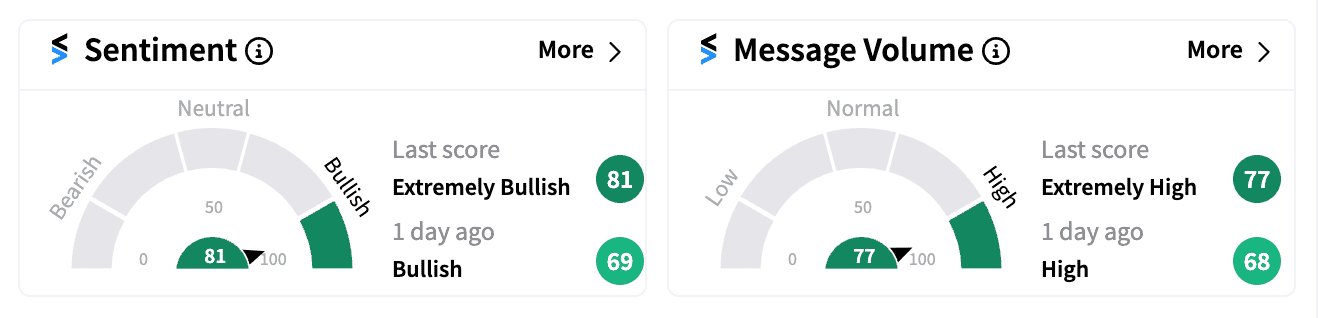

Retail interest in the stock rose on Stocktwits, with Disney ranking among the top 20 trending symbols as of 12:40 pm ET.

Sentiment around the ticker turned ‘extremely bullish,’ with message volume spiking dramatically.

Analysts on Wall Street are expecting Disney’s adjusted fiscal Q4 earnings per share (EPS) to increase to $1.11, up from $0.82 a year ago, while revenue is projected to rise to $22.49 billion from $21.24 billion.

Disney has beaten profit estimates in the last four quarters but has missed revenue expectations three times.

Many retail investors on Stocktwits shared their bullish outlook, with one popular post predicting that the stock could break above $110 after earnings.

Another user highlighted the potential impact of Disney’s price increase for its streaming service in October.

Despite challenges such as a slowdown in consumer activity at its parks, some analysts remain optimistic about Disney’s content pipeline, including recent box office hits like Inside Out 2 and Deadpool & Wolverine.

The sequel to Disney’s most streamed movie of all time, Moana, is also set to hit theaters at the end of the month.

The company has faced a turbulent leadership transition with the search for a successor to CEO Bob Iger. External candidates, including Andrew Wilson, CEO of Electronic Arts ($EA), have reportedly been considered for the role.

Evercore ISI analyst Vijay Jayant raised the firm’s price target for Disney to $128 from $105, maintaining an ‘Outperform’ rating on the stock.

The brokerage remains bullish ahead of Disney’s Q4 results, expecting improving profitability for its Direct-to-Consumer (DTC) business, which includes Disney+, and continued strength from the Studio segment.

However, challenges at the Theme Parks and the DirecTV carriage dispute are expected to partially offset these positives.

Disney’s stock has gained more than 12% this year, though it has underperformed compared to broader market indices.

For updates and corrections, email newsroom@stocktwits.com

Read next: Soundhound AI Stock Slips Deeper Post Earnings: Analyst Turns Bearish, But Retail Hangs Tight

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_da95861470.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233716109_jpg_230d917a7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)