Advertisement|Remove ads.

Disney-Backed A+E Global May Be Up For Grabs: Retail Remains Skeptical

A+E Global Media, the parent company of A&E, History and Lifetime cable networks, is reportedly weighing a potential sale as part of a broader strategic review.

According to a report from Deadline, the company has engaged Wells Fargo to assess options, which include a complete sale, joint ventures, or other strategic partnerships.

A+E Global Media, previously known as A+E Networks, is jointly owned by the Walt Disney Company and Hearst, with each holding a 50% stake.

Walt Disney stock inched 0.8% lower on Tuesday afternoon following the news.

As traditional cable audiences shrink and ad revenue continues to drop, several established media firms are restructuring by carving out their cable divisions.

For instance, Comcast Corp (CMCSA) has launched Versant to house its cable properties, and Warner Bros. Discovery (WBD) is in the process of splitting its cable networks from its film and streaming businesses.

While cable networks continue to generate cash, according to the report, some analysts believe that shedding these assets could unlock value.

The rise of streaming during the Covid pandemic has continually eroded viewership for traditional linear television across the media landscape.

Forming a partnership or pursuing a sale could allow A+E to simplify its structure and redirect resources toward expansion opportunities.

A&E Global represents the most prominent equity stake within Disney’s linear TV portfolio.

The entertainment giant’s linear holdings span both local broadcast outlets and a range of domestic and global cable networks, including Disney Channel, Freeform, and National Geographic.

In recent years, Disney has been reevaluating the role of its traditional television channels. Bob Iger, the company’s CEO, was among the first to suggest that linear TV might be considered “non-core” to Disney’s long-term strategy.

However, the company later paused its initial exploration of divesting those assets after its leadership determined they still played a supportive role alongside its streaming platforms.

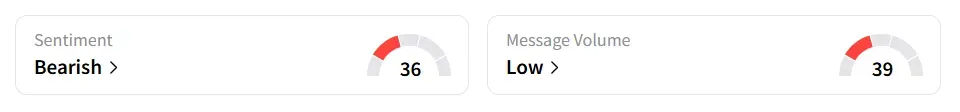

On Stocktwits, retail sentiment toward Walt Disney remained in ‘bearish’ territory with ‘low’ message volume levels.

Walt Disney stock has gained over 9% in 2025 and over 25% in the last 12 months.

Also See: SharpLink Gaming Boosts Ethereum Reserve To 205K: Retail Optimism Abounds As Stock Surges

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252194207_jpg_9605cd50d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)