Advertisement|Remove ads.

Disney Seals Full Hulu Takeover With Extra $438.7M Payout To NBCU — Retail Applauds The Deal

Disney said it would pay an additional $438.7 million to Comcast-owned NBC Universal to get complete ownership of Hulu.

According to an SEC filing, the proposed payment was finalized after the contractual appraisal process that was completed on June 9.

When NBC exercised its option to have Disney buy out its Hulu stake in November 2023, a guaranteed floor value of $27.5 billion was agreed upon. Disney paid NBC about $8.6 billion in December, reflecting the guaranteed floor value, less NBC’s unpaid capital call contributions.

Following disagreements between the two parties regarding the valuation of NBC’s Hulu stake, a third appraiser’s input was considered.

The additional payment now deemed to be paid by Disney is far less than the $5 billion that NBC sought.

With the additional payment, NBC’s 33% stake in Hulu is valued at $9.04 billion.

Disney said the amount will be recorded in “net income attributable to noncontrolling interests” and would reduce “Net income attributable to Disney” in its Condensed Consolidated Statements of Income for our fiscal third quarter.

The company also clarified that the amount will be excluded from its adjusted earnings per share (EPS), and will unlikely impact its fiscal 2025 adjusted EPS guidance.

In a statement, Disney said, “We are pleased this is finally resolved. We have had a productive partnership with NBCUniversal, and we wish them the best of luck.”

“Completing the Hulu acquisition paves the way for a deeper and more seamless integration of Hulu’s general entertainment content with Disney+ and, soon, with ESPN’s direct-to-consumer product, providing an unrivaled value proposition for consumers.”

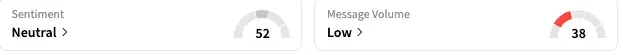

On Stocktwits, retail sentiment toward the Disney stock was ‘neutral’ (53/100) by late Monday, improving from the ‘bearish’ mood a day ago, with the message volume at ‘low’ levels.

Following the Hulu buy, a user said, “Disney is now the most powerful case for streaming as they begin to bring all their media assets under one umbrella.”

Another watcher shared a chart and said a “huge winner brewing in $DIS.”

Disney stock ended Monday’s session up 1.55% at $115.66, and is up about 4% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Wall Street Losing Its Global Appeal? Tariff Rally Fails To Lure Back Asian Traders

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1163170868_jpg_3975bd8be2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)