Advertisement|Remove ads.

Trump Media Stock Heads For 3rd Day Of Losses, Retail Interest Dips After Election-Triggered Rally

Shares of Trump Media & Technology Group Corp. ($DJT) slumped over 7% on Thursday, setting them on course for their third consecutive day in the red.

The stock is now trading below $27, a sharp decline from its Election Day high of $35.96. On Oct. 29, DJT shares closed at $51, still well below their record high of $66 set in March after merging with a blank-check firm.

Prior to the Nov. 5 election, Trump Media shares had traded as a volatile proxy for Donald Trump’s presidential chances.

With a market cap exceeding $6 billion, the company’s valuation is seen as “meme-stock”-like, according to MarketWatch, especially given its modest third-quarter revenue of just $1 million against an operating loss of $23.7 million.

Barron’s says the stock’s average holding period is less than two days, in stark contrast to longer-term investments like Apple, where the average holding period exceeds a year.

The recent sell-off intensified on Wednesday, following reports that insiders are planning to offload shares.

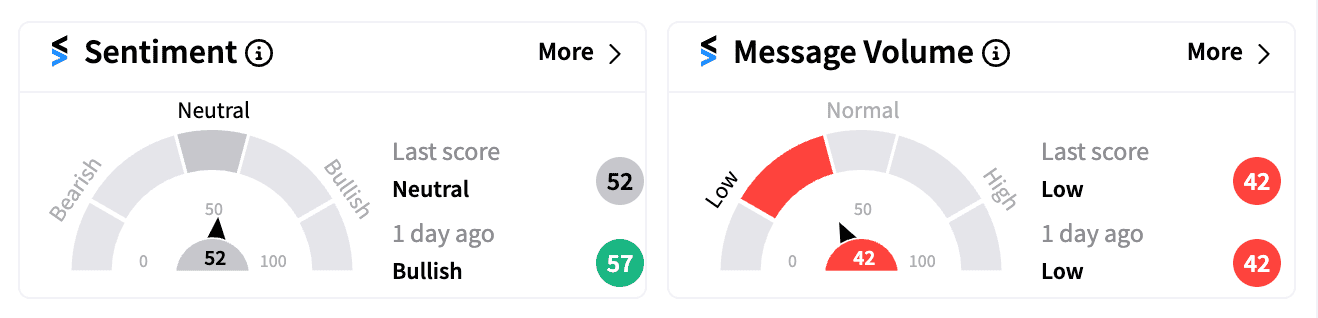

Retail sentiment on Stocktwits shifted to ‘neutral’ on Thursday afternoon from ‘bullish’ just a day prior.

The stock has shed more than 5% in value over the past week, accompanied by a sharp 87% drop in message volume on Stocktwits, suggesting waning retail interest despite optimism surrounding Trump’s election victory.

Adding to the headlines, Trump Media announced on Thursday that it has fully deployed cross-country data centers to support its new Truth+ streaming platform.

The platform aims to deliver ultra-fast streaming, live TV, and on-demand content, backed by a custom-built content delivery network.

Trump Media said it aims to leverage nearly $700 million in cash reserves and a debt-free balance sheet.

Future expansion plans include availability on connected TV systems like Samsung, LG, and Roku, the company added.

Shares of Trump Media are down more than 55% since their SPAC merger back in March.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)