Advertisement|Remove ads.

Trump Media Stock Surges To 6-Week High After Truth+ Streaming App Launch: Retail Buzz Spikes

Shares of Trump Media & Technology Group (DJT) surged 16% on Thursday afternoon, reaching levels last seen in late August, following a new product launch.

The company announced the release of its Truth+ TV streaming app for Android devices, now available in the Google Play Store. Truth+ offers a mix of TV programming including news, entertainment, faith-based content, weather updates, documentaries, and children’s shows, featuring both linear TV channels and Video on Demand.

Trump Media said that iOS and TV platform versions of the app are coming soon.

Trading volume spiked to over 34 million shares, more than double the stock’s 30-day average of approximately 14.16 million shares.

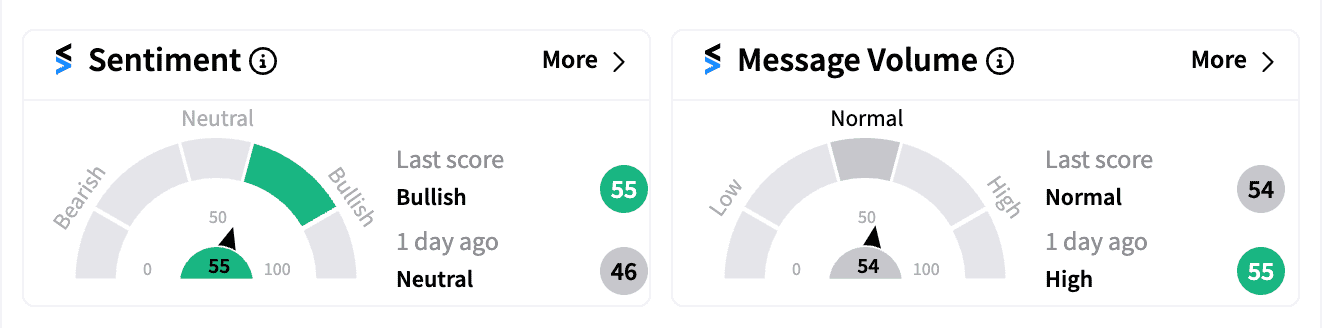

On Stocktwits, DJT was the second-most active stock by message volume on Thursday, with retail sentiment showing a slight uptick in bullishness compared to the previous day.

The stock has been rallying since Tesla CEO Elon Musk appeared alongside former President Donald Trump at a campaign rally in Butler, Pennsylvania, over the weekend.

The rally marked Trump’s return to the site of a failed assassination attempt in July, with Musk endorsing Trump shortly after the incident.

Trump holds nearly 60% of DJT’s outstanding shares, which rose as high as $79.38 apiece in March after a SPAC merger.

However, the stock has since fallen by nearly 65%, weighed down by weak Q2 earnings, which included a $16.4 million net loss and a 30% drop in revenue.

Insider selling concerns and the political climate ahead of the November election have added to the volatility.

Read next: AZZ Stock Falls After Q2 Revenue Narrowly Misses Estimates, But Retail’s Happy With Profit Beat

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2225607834_jpg_ea81c43992.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_toyota_logo_resized_dc32fc91b6.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/08/nvidia-2024-08-72b20e5921be505e7136db21db1e66f7.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2022/04/PayPal.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/TMC_resized_jpg_7e9bc7902f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/stock-market-2025-10-128c284bec3448e678cc68969f3ed130.jpg)