Advertisement|Remove ads.

DLF Sees Breakout Rally On Robust Q4: Wait For Pullback Before Buying, Says SEBI RA Prabhat Mittal

DLF, India’s leading real estate developer, saw its shares rise nearly 5% on Tuesday after reporting strong March-quarter (Q4) earnings and record-breaking FY25 sales.

The company posted a 39% year-on-year increase in Q4 net profit, reaching ₹1,282 crore.

This robust performance was driven by all-time high new sales bookings of ₹21,223 crore for the fiscal year: a key metric that signals growing demand and effective project execution.

SEBI-registered analyst Prabhat Mittal highlighted the technical strength behind DLF's recent rally.

He noted that the stock decisively broke past a major resistance level at ₹715 following the earnings announcement, a move further validated by the stock crossing its 200-day moving average.

This crossover often signals a shift in the long-term trend and has reinforced bullish sentiment.

However, Mittal advises caution for traders at the current price, noting that the next key resistance lies at ₹793.

Instead of entering at elevated levels, he recommends waiting for a price retracement to the ₹735–₹740 range before considering new long positions.

A strict stop loss at ₹709 is suggested for such entries, with upside targets set at ₹793 and ₹900.

Institutional sentiment has also remained positive. Global brokerage Morgan Stanley maintained its ‘Overweight’ rating on DLF with a target price of ₹910, implying an upside of over 23% from current levels.

The strong earnings and a healthy outlook for the real estate sector have boosted investor confidence.

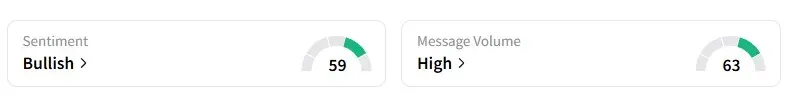

According to Stocktwits data, retail sentiment flipped from ‘bearish’ to ‘bullish’ last week, signaling a notable shift in trader positioning.

DLF shares have fallen 6% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)