Advertisement|Remove ads.

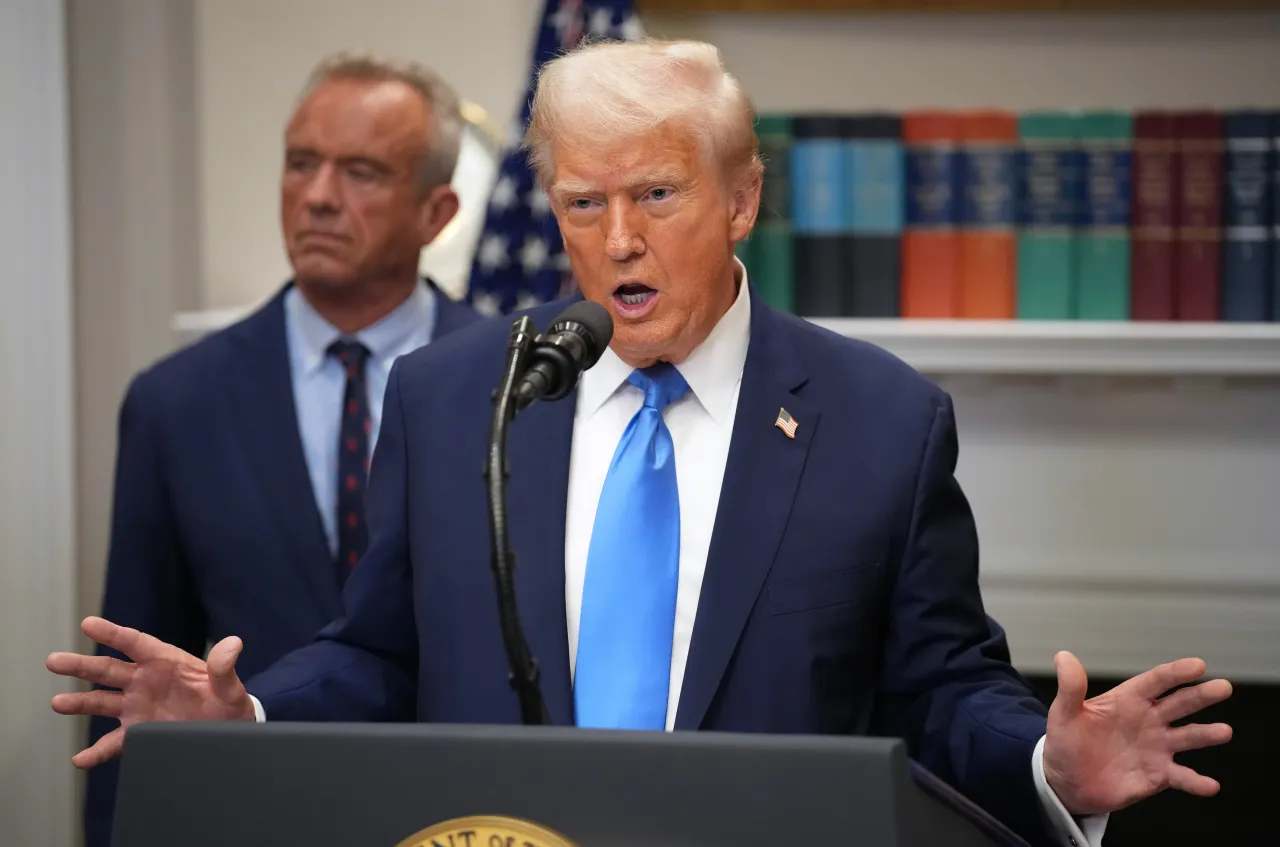

Trump Steps Up Pressure On Trading Partners Over Drug Costs, Plans Section 301 Review: Report

- The Trump administration is preparing a Section 301 investigation to assess whether U.S. trading partners underpay for prescription drugs, a move that could pave the way for new tariffs.

- Earlier this month, the White House confirmed generic drugs would be excluded from potential duties, reversing earlier discussions under the Section 232 national security review.

- The probe expands Trump’s broader effort to pressure pharmaceutical companies and foreign governments to “equalize” drug prices globally.

President Donald Trump’s administration reportedly is stepping up pressure on U.S. trading partners over drug costs, preparing a Section 301 investigation under the Trade Act of 1974 to determine whether countries are underpaying for prescription medicines.

The move could pave the way for new tariffs and marks a renewed escalation in Trump’s campaign to “equalize” drug prices globally, according to a Financial Times report, citing three people familiar with the matter.

Trump has long argued Americans pay disproportionately high prices for the same drugs sold abroad, citing last week that “in London, you’d buy a certain drug for $130 … and in New York, you pay $1,300 for the same thing.”

U.S. drug prices average nearly three times higher than in other developed economies, according to the Rand Corporation. Novo Nordisk’s Ozempic, for instance, costs about $936 per month in the U.S., versus $147 in Canada and $83 in France, KFF data show.

Generic Drugs Excluded From Tariff Plans

Earlier this month, the White House said it isn’t planning tariffs on generic drugs, narrowing the scope of its trade actions. Officials had been weighing such duties under Section 232 of the Trade Expansion Act, which permits tariffs on national security grounds.

White House spokesman Kush Desai said the administration “is not actively discussing imposing Section 232 tariffs against generic pharmaceuticals.” The Commerce Department also said such tariffs were unlikely, marking a reversal from Trump’s 2023 campaign pledge to restore domestic production of all essential medicines.

Advisers, including members of the Domestic Policy Council and health aide Theo Merkel, warned tariffs on generics could raise prices and cause shortages, given that India supplies nearly half of U.S. generic drugs. Commerce officials, however, continue to explore quotas or incentives to rebuild U.S. drug manufacturing capacity.

Broader Pharma Trade Push

The Section 301 move expands Trump’s broader effort to tie drug pricing policy to trade leverage. Earlier this year, he demanded that pharmaceutical companies offer the U.S. their best global price or face penalties.

Major firms, including Pfizer, AstraZeneca, Novo Nordisk, and Eli Lilly, have all held pricing talks with the White House. Trump previously reached a deal with the EU to cap drug import tariffs at 15% and is negotiating with the U.K. for lower duties in exchange for higher payments to drugmakers.

While Trump last month threatened 100% tariffs on branded drugs to force companies to expand U.S. manufacturing, those measures have yet to materialize. Officials said firms will be given time to invest domestically and demonstrate pricing reforms.

Desai said the White House is pursuing a “multi-faceted approach” that could include federal grants or loans, potentially with funding from foreign partners like Japan, to strengthen U.S. drug supply chains and reduce dependence on imports.

Stocktwits Traders See Muted Interest For Healthcare ETFs

On Stocktwits, retail sentiment toward the Health Care Select Sector SPDR Fund (XLV) was ‘bearish’ and toward the iShares Global Healthcare ETF (IXJ) was ‘neutral,’ both amid ‘low’ message volume.

So far this year, XLV is up 7%, while IXJ has gained 9%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)