Advertisement|Remove ads.

DMC Global Stock Rises After Receiving Non-Binding Buyout Proposal From Steel Connect: Retail Turns Bullish

DMC Global (BOOM) shares surged nearly 10% on Monday after the company confirmed it had received a non-binding buyout proposal from Steel Connect.

The company said that Steel Connect, its largest shareholder, has agreed to pay $10.18 per share in cash for the rest of DMC’s shares.

DMC said that the proposal is subject to further due diligence by Steel Connect, and there are no assurances that the deal would be agreed upon.

Steel Connect, which owns about 9.9% of DMC’s outstanding shares, has been pursuing a deal since last year.

It had first sent out a proposal to buy the company for $16.50 per share in May.

DMC had rejected the offer.

Steel Connect then offered to buy DMC’s DynaEnergetics and NobelClad businesses at a price ranging between $185 million and $200 million in cash and the DMC stock it owned.

Later in November, it sought to buy the remaining 40% of the DMC’s Arcadia business.

DMC had adopted a poison pill to prevent Steel Connect from raising its stake in the company. Steel Connect had urged DMC to withdraw the poison pill in January.

DMC, which manufactures and sells products and services to the energy, industrial, and building products markets, has also changed several chief executives over the past two years.

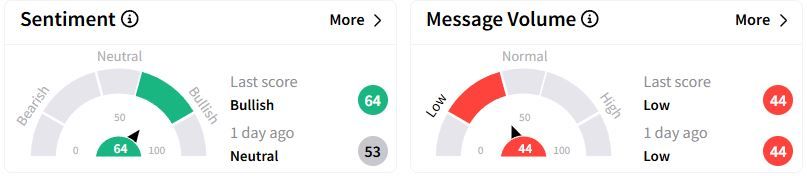

Retail sentiment on Stocktwits jumped to ‘bullish’ (64/100) territory from ‘neutral’(53/100) a day ago, while retail chatter remained ‘low.’

One user said that it would be a ‘steal deal’ if Steel Connect managed to purchase the company.

Over the past year, DMC Global stock has fallen 51.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219715394_jpg_c787a7b591.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_martin_shkreli_jpg_4da92d4843.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)