Advertisement|Remove ads.

Dollar General Defies Trump Tariff Turmoil To Become Top S&P 500 Consumer Stock Star In First Half Of 2025

Dollar General (DG) emerged as the top consumer sector stock in the first half of 2025, a period marked by intense market volatility due to President Donald Trump's policy salvos.

DG shares rose over 50% in the six months through June, compared to the 5.4% rise in the benchmark S&P 500 (SPX) index in this period.

Unlike much of the market, Dollar General largely escaped the dire effects of the U.S. tariffs, which have disrupted business outlooks amid concerns over rising operational costs and consumer prices.

Analysts have noted that over recent months, Dollar General's low-cost products, which are also essential household items, have proven to be the company's selling point amid economic uncertainty. Consumers seeking cheaper alternatives for everyday goods flocked to the chain.

Dollar General also reaped the benefits of a key strategy to streamline operations, which began last year. Under its 'Back-to-Basics' plan, the chain has replaced self-checkouts with human-assisted checkouts, trimmed its product selection, and increased staff at its stores to provide a better experience and value to customers.

The efforts paid off. In May, the company raised its annual forecast after reporting better-than-expected first-quarter results, resulting in its best-ever 16% intraday surge in shares.

Following the recent rally in shares, some analysts have begun to temper their expectations for further upside. Goldman Sachs last week downgraded its rating to 'neutral' from 'buy.'

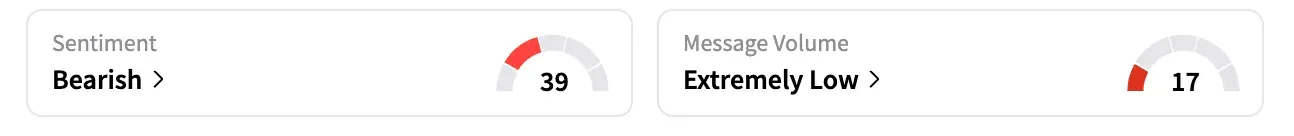

On Stocktwits, the retail sentiment was 'bearish' as of early Wednesday, unchanged from a month ago.

A user said that the rally in the stock is probably driven by interest from institutional investors.

Dollar General competes with Walmart, Target, Costco, and Best Buy.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)