Advertisement|Remove ads.

Dollar General Stock Rises As Wall Street Analysts Raise Price Targets: Retail Bullish

Dollar General Corp (DG) shares gained 5% on Monday to hit their highest level since August last year, after some Wall Street analysts raised their price targets on the stock.

Morgan Stanley raised its target to $85 from $80, and maintained its 'Overweight' rating.

Goldman Sachs raised the target to $96 from $85 and maintained its 'Buy' rating.

Dollar General shares, which have gained in the last four sessions, ended at $98.18 on Monday.

Analysts are starting to spot an opportunity in Dollar General stock. The retailer’s focus on low-cost, everyday essentials is becoming increasingly appealing to consumers feeling the pinch of high inflation and a shaky economy.

Last week, Evercore ISI added Dollar General to its "Outperform Tactical and Action Positioning Call List," a curated selection of stocks Evercore believes are poised for near-term outperformance due to specific catalysts.

Evercore said the discount retailer's Q1 earnings release and likely guidance update should "keep the stock grinding higher."

Bernstein and Guggenheim have also raised their price targets on Dollar General in recent weeks.

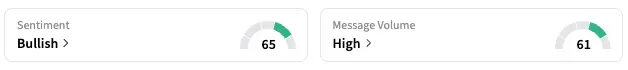

On Stocktwits, the retail sentiment turned 'bullish' from 'bearish' the prior day.

A user was encouraged that "huge brokerages are scaling into DG, and other consumer staples. DG pays a good dividend too."

Dollar General stock is up nearly 30% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2238161001_jpg_d763653491.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202902434_jpg_34a840ada1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_CZ_ZHAO_OG_2_jpg_f6124171e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248471134_jpg_9957fc576c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)