Advertisement|Remove ads.

Dow Futures Edge Higher As Fed’s Liquidity Boost, Bowman’s Testimony Take Center Stage: MDB, CRDO, WBD, CRWD Among Stocks To Watch

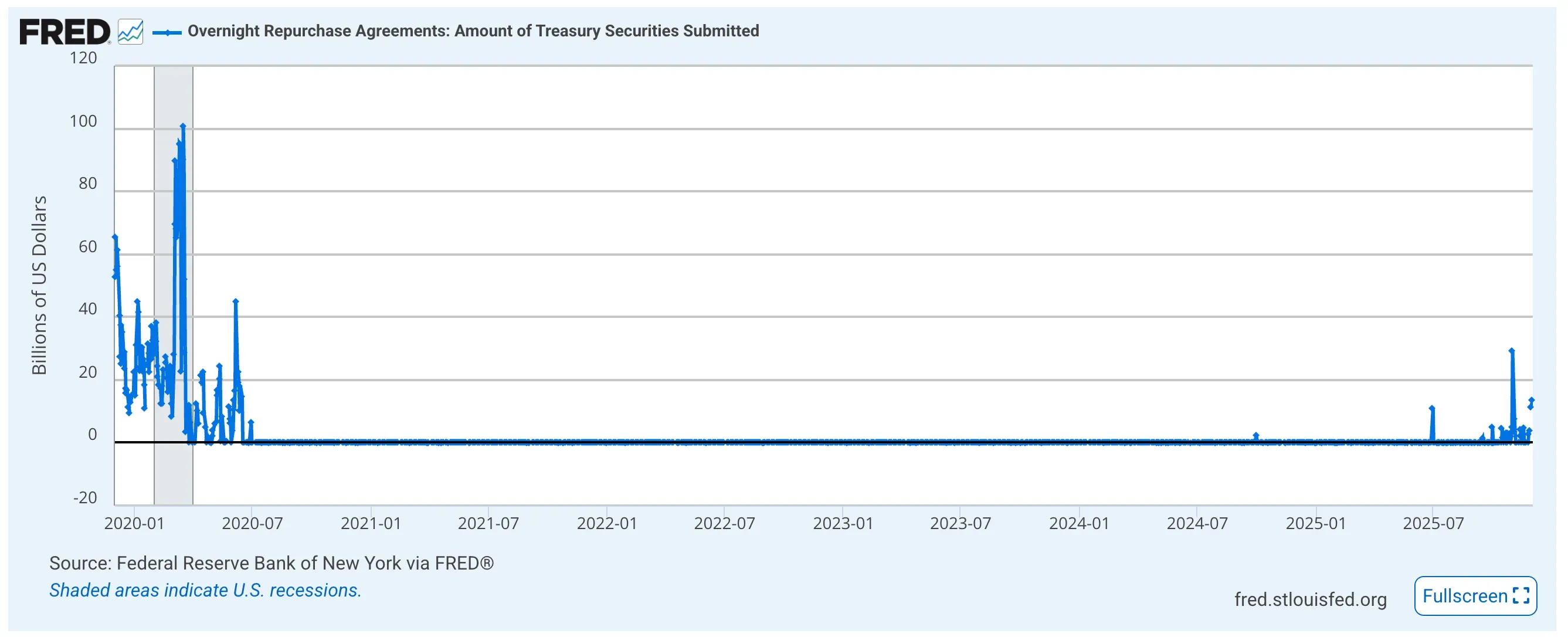

- The Federal Reserve conducted one of its largest overnight repo operations since the COVID-19 pandemic on Monday, injecting $13.5 billion of liquidity into the U.S. banking system.

- Asian markets ended Tuesday’s trading session on a largely positive note, with the KOSPI leading with gains of 1.87%.

U.S. stocks appear set for a cautious start on Tuesday, as investors tread carefully after major indexes began December on a negative note.

Federal Reserve Vice Chair for Supervision Michelle Bowman plans to tell lawmakers in the House on Tuesday that she will work to set new rules for banks and stablecoins to encourage innovation in a “responsible manner.”

Meanwhile, the Federal Reserve conducted one of its largest overnight repo operations since the COVID-19 pandemic on Monday, injecting $13.5 billion of liquidity into the U.S. banking system. It injected $29.4 billion of liquidity on Oct. 31, 2025, the highest since the COVID-era repo operations.

Futures Edge Higher

Dow Jones futures were up by 0.08%, the S&P 500 futures gained 0.12%, and the tech-heavy Nasdaq 100’s futures rose 0.22%. Futures of the Russell 2000 index were up by 0.5%.

Meanwhile, the SPDR S&P 500 ETF (SPY) was up by 0.1% at the time of writing, Invesco QQQ Trust (QQQ) gained 0.17% on Tuesday morning, and SPDR Dow Jones Industrial Average ETF Trust (DIA) edged up by 0.02%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bullish’ territory.

Asian Markets Largely Positive

Asian markets ended Tuesday’s trading session on a largely positive note, with the KOSPI leading with gains of 1.87%, followed by the TWSE Capitalization Weighted Stock index at 0.8%, the Hang Seng at 0.12%, and the Nikkei 225 at 0.08%.

The Shanghai Composite declined 0.42%.

Stocks To Watch

- MongoDB Inc. (MDB): MongoDB shares gained nearly 23% pre-market after the company’s third-quarter (Q3) earnings beat Wall Street expectations. MongoDB reported earnings per share (EPS) of $1.32 on revenue of $628.3 million, compared to analyst estimates of an EPS of $0.81 on revenue of $593.9 million, according to Stocktwits data.

- Credo Technology Group Holding (CRDO): Credo Technology shares were up more than 17% pre-market after the company’s second-quarter (Q2) earnings beat Wall Street expectations. Credo reported EPS of $0.67 on revenue of $268 million, compared to analyst estimates of an EPS of $0.49 on revenue of $235 million, according to Stocktwits data. Their CFO has outlined aggressive growth plans ahead.

- Warner Bros. Discovery Inc. (WBD): According to a report by The Wall Street Journal, Comcast Corp. (CMCSA), Netflix Inc. (NFLX), and Paramount Skydance Corp. (PSKY) submitted their second offers for Warner Bros. Discovery. WBD shares were up nearly 2% pre-market.

- CrowdStrike Holdings Inc. (CRWD), Marvell Technology Inc. (MRVL), and Okta Inc. (OKTA) are among the companies scheduled to report their latest quarterly earnings on Tuesday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)