Advertisement|Remove ads.

DraftKings Stock Drops Premarket On Lower Revenue Forecast: CEO Downplays Threat From Prediction Markets

- DraftKings trimmed its annual revenue forecast by about $300 million.

- The sports betting firm missed analysts' revenue target for Q3, although net loss narrowed year-over-year.

- CEO Jason Robins says prediction markets and sports betting are very different offerings, and, as such, not a competitive challenge for DraftKings.

DraftKings, Inc.’s shares declined 8% in early premarket trading on Friday, after the company lowered its full-year sales outlook and reported mixed third-quarter results, amid concerns that prediction market services are eating into the sports betting business.

Outlook Cut

DraftKings trimmed its full-year revenue forecast by about $300 million to a $5.9 billion to $6.1 billion range.

The revised outlook takes into account the spending on launching mobile sports betting in Missouri later this year and the rollout of a new prediction markets app, the company stated. Last month, DraftKings acquired prediction markets platform Railbird, marking its entry into the space.

CEO Dismisses Prediction Market Challenge

In an interview with CNBC, DraftKings Jason Robins dismissed concerns of competition with prediction market players. He said prediction markets aren’t driving customers out of sports betting, stressing that the two have different offerings.

“Simply going and spending five minutes looking at the products, you’ll see what I mean — it’s night and day,” Robins told CNBC’s Jim Cramer. “The amount of markets, even the pricing, isn’t something that I would view as competitive with what we do.”

DraftKings’ stock has been under pressure recently amid investor concerns over growing competition from prediction market platforms, which some believe are cannibalizing the audience for sports betting firms such as DraftKings and FanDuel operator Flutter Entertainment.

Kalshi, a leading player in the space, has expanded into sports betting with a new parlay product. Meanwhile, Robinhood announced on Wednesday that trading volume on its prediction markets platform has doubled every quarter since its launch last year.

Q3 Performance

Revenue in the third quarter rose 4% to $1.14 billion, but missed analysts’ expectations of $1.21 billion, driven by a 2% increase in monthly unique players and a 3% rise in the average revenue per monthly unique player.

However, net loss narrowed to $256.8 million from $293.7 million in the year-ago quarter.

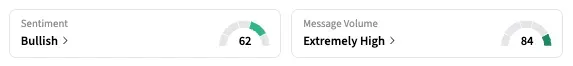

On Stocktwits, the retail sentiment for DKNG shifted to ‘bullish’ as of early Friday, from ‘neutral’ the previous day.

As of the last close, DKNG stock is down about 25% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Door_Dash_jpg_1088720ba5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_thiel_OG_jpg_9d74d987ca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUV_Southwest_bags_jpg_0c65f623c2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)